E3 Compliance Cost Calculator

How E3 Compliance Costs Work

E3 Compliance Technologies offers tiered pricing based on exchange size and feature requirements. Your costs depend on your user base and which compliance features you need.

Important: E3CT pricing starts at $1,200/month for basic compliance features. Enterprise plans exceed $15,000/month.

Calculate Your E3 Cost

Estimated Monthly Cost

Enter your details above to see your estimated cost.

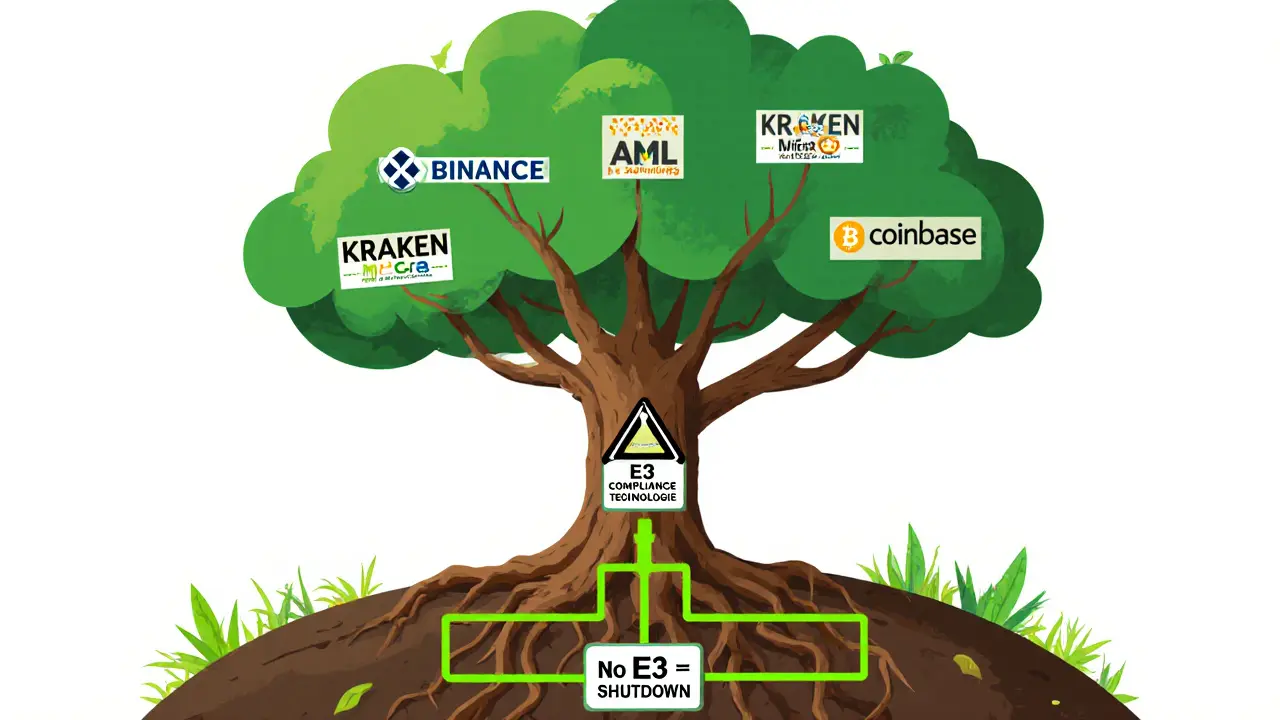

There’s no such thing as an "E3 crypto exchange." If you’re searching for reviews on E3 as a place to buy or trade Bitcoin, Ethereum, or altcoins, you’re looking in the wrong place. E3 isn’t a crypto exchange at all. It’s E3 Compliance Technologies - a behind-the-scenes compliance platform used by real crypto exchanges to stay legal.

Why People Think E3 Is a Crypto Exchange

The confusion is understandable. Search engines, forums, and even some news sites mix up the name. People type "E3 crypto exchange" because they’re trying to find a trading platform. But when they land on E3CT’s website, they see tools for AML, KYC, and transaction monitoring - not a wallet, not a trade order book, not even a login for trading. That’s because E3 doesn’t handle your crypto. It handles the paperwork, the audits, the regulators. Think of it like this: Coinbase is the grocery store. E3 is the health inspector who makes sure the store isn’t selling spoiled food, fake labels, or hidden illegal goods. Without E3, Coinbase could get shut down. That’s how critical this company is - if you’re running a crypto exchange, you need something like E3 just to stay open.What E3 Compliance Technologies Actually Does

E3CT is a SaaS platform built for crypto businesses that need to follow the law. Their job? Automate the parts of compliance that would otherwise take teams of lawyers and analysts months to handle manually. Here’s what they actually deliver:- KYC (Know Your Customer): Verifies user identities using government IDs, selfies, and biometrics before they can trade.

- AML (Anti-Money Laundering): Flags suspicious transfers - like someone sending $50,000 in Bitcoin to a known darknet address.

- Transaction Monitoring: Watches every deposit and withdrawal in real time using machine learning. Their system catches 98.7% of risky transactions, according to a third-party audit by Kudelski Security.

- Regulatory Reporting: Automatically files reports to FinCEN, FATF, and EU authorities when required.

- MiCA Compliance: Their biggest selling point. If your exchange operates in the European Union, you’re legally required to follow MiCA rules by December 2024. E3CT has pre-built templates that cut implementation time by 40% compared to industry average.

How Much Does E3 Cost?

This isn’t a free tool. You’re paying for regulatory survival. - Basic Plan: Starts at $1,200/month. Good for small exchanges with under 5,000 active users. Includes KYC, basic monitoring, and standard reporting.

E3 vs Chainalysis vs Elliptic

You’ll often hear E3 compared to Chainalysis or Elliptic. But they’re not the same thing.| Feature | E3 Compliance Technologies | Chainalysis Reactor | Elliptic |

|---|---|---|---|

| Primary Focus | Exchange compliance workflows | Forensic blockchain investigation | Transaction risk scoring |

| Blockchain Coverage | 85% | 99.2% | 97% |

| MiCA Compliance | Best-in-class, pre-built templates | Basic support | Good, but slower setup |

| Implementation Time | 2-4 weeks | 4-8 weeks | 3-6 weeks |

| Best For | Mid-sized EU exchanges | Law enforcement, large exchanges needing forensic depth | Exchanges needing risk scoring for DeFi and wallets |

Real User Experiences

On G2 Crowd, E3CT has a 4.3/5 rating from 87 verified users. The most common praise? "They update their system the moment new regulations drop. We didn’t have to scramble when MiCA launched." But there are complaints too:- False Positives: One user reported 15% of flagged transactions were legitimate. That means compliance staff spent hours manually reviewing transfers that weren’t risky.

- Learning Curve: The interface isn’t intuitive for non-compliance professionals. A Reddit user wrote, "I had to hire a former bank AML officer just to make sense of the dashboard."

- Integration Hassles: 68% of users said mapping their exchange’s transaction data to E3’s required format was the hardest part. If your exchange uses a weird wallet architecture, expect delays.

Who Should Use E3?

E3CT isn’t for everyone. Here’s who it’s built for:- Exchanges operating in the EU: If you’re serving customers in Germany, France, or Spain, MiCA compliance isn’t optional. E3 is one of the few platforms that makes it manageable.

- Mid-sized exchanges with 5,000-50,000 users: Big players like Binance have in-house legal teams. Small exchanges can use cheaper tools like Notabene. E3 hits the sweet spot for those in between.

- Exchanges that want to avoid fines: The EU can fine non-compliant exchanges up to 5% of their annual revenue. E3’s automated reporting cuts that risk dramatically.

- Exchanges in countries with no crypto regulation (yet) - you don’t need this level of compliance.

- Exchanges that need deep forensic tools to track stolen funds - go with Chainalysis.

- Startups with under $1M in revenue - the cost outweighs the benefit until you’re scaling.

The Bigger Picture: Why Compliance Is No Longer Optional

The crypto world is changing fast. In 2024, the global crypto compliance market hit $1.2 billion. By 2029, it’s expected to hit $5 billion. Why? Because regulators are no longer asking. They’re demanding. The EU’s MiCA law, the US’s FinCEN guidance, and Dubai’s VARA rules are forcing every exchange to prove they’re not being used for laundering, terrorism financing, or tax evasion. You can’t just say "we’re decentralized" anymore. The law doesn’t care. E3CT isn’t glamorous. It doesn’t make headlines. But if your exchange wants to survive 2025 and beyond, you’ll need a tool like this. It’s not about being cool. It’s about being legal.What’s Next for E3?

E3CT announced two major updates in late 2024:- AI Risk Scoring (Q1 2025): Instead of just flagging transactions, the system will now predict which users are likely to become high-risk over time.

- Middle East Expansion (Q2 2025): Support for ADGM (Abu Dhabi) and Dubai VARA regulations - a big move as those markets grow.

But there’s a warning: Deloitte predicts half of all specialized compliance vendors will disappear by 2027 through mergers. Chainalysis is already expanding into exchange compliance. If E3 doesn’t keep innovating, they could get swallowed.

Is E3 a crypto exchange where I can buy Bitcoin?

No, E3 is not a crypto exchange. It’s E3 Compliance Technologies - a regulatory software platform used by exchanges like Binance and Kraken to meet legal requirements. You cannot trade crypto on E3. It doesn’t have wallets, order books, or trading interfaces.

How much does E3 Compliance Technologies cost?

E3CT pricing starts at $1,200 per month for basic compliance features like KYC and transaction monitoring. Mid-tier plans cost around $5,000/month, and enterprise solutions exceed $15,000/month. They also offer a MiCA Complete package at $3,500/month for EU-based exchanges. Additional fees may apply for API overages or custom integrations.

Does E3 work with US exchanges?

Yes, E3CT supports US exchanges and helps them comply with FinCEN’s AML/KYC rules under the Bank Secrecy Act. However, their strongest features are optimized for EU regulations like MiCA. US exchanges often use E3 alongside other tools for broader coverage.

What’s the difference between E3 and Chainalysis?

E3CT automates compliance workflows for exchanges - KYC, reporting, regulatory updates. Chainalysis is a forensic tool used by law enforcement and large exchanges to trace illicit transactions across blockchains. Chainalysis has deeper blockchain coverage (99.2% vs E3’s 85%) but is slower and more expensive for day-to-day compliance.

How long does it take to implement E3?

Full integration typically takes 2 to 4 weeks. This includes API setup, data mapping, testing, and staff training. Exchanges report spending 35-50 internal staff hours during implementation. Some face delays if their exchange architecture is non-standard or if they need custom risk rules.

Is E3 good for small crypto exchanges?

For very small exchanges (under 5,000 users), E3CT may be overkill and expensive. Cheaper alternatives like Notabene or ComplyAdvantage might be better. But if you’re growing fast or targeting European users, E3’s MiCA compliance tools can save you from costly fines - making it worth the investment even at smaller scales.

Kathy Ruff

5 11 25 / 17:48 PME3 isn't a trading platform, but it's the silent guardian keeping exchanges from getting shut down. Without tools like this, even legit platforms would be drowning in regulatory paperwork. It's not sexy, but it's essential infrastructure.

Robin Hilton

6 11 25 / 07:33 AMSo we're paying $15k a month so some software can check IDs? Meanwhile, my cousin in Belize trades crypto via Telegram with a photo of his passport and no questions asked. This whole compliance circus is just a tax on innovation.

Grace Huegel

6 11 25 / 11:14 AMThe fact that anyone still thinks E3 is an exchange speaks volumes about the collective delusion in this space. People want magic buttons that turn Bitcoin into cash without any accountability. E3 exposes that fantasy. And that’s why it’s hated.

Nitesh Bandgar

7 11 25 / 15:11 PMOhhhhh, so E3 is the invisible hand of the state, whispering in the ears of Binance and Kraken?! They’re not just monitoring transactions-they’re watching YOUR MOVEMENTS, YOUR HABITS, YOUR LIFE! Every deposit, every withdrawal, every damn selfie you take for KYC is being stored in some corporate server farm with a name like ‘Compliance Nexus 7’! This isn’t safety-it’s digital slavery with a $5,000 monthly subscription!

Jessica Arnold

9 11 25 / 06:24 AMIt’s fascinating how the crypto community conflates decentralization with regulatory arbitrage. E3 represents the inevitable institutionalization of the space-not as a betrayal, but as a maturation. The blockchain doesn’t care about jurisdiction, but legal systems do. E3 is the bridge between cryptographic ideals and real-world legal frameworks. It’s not about trustlessness anymore-it’s about accountable trust.

Chloe Walsh

10 11 25 / 09:50 AMSo let me get this straight… we’re paying for software to stop us from being criminals… but the real criminals are still out there using Monero and mixers while E3’s clients are busy filling out forms? This feels less like compliance and more like a performance art piece titled ‘How to Look Responsible While Doing Nothing’

Stephanie Tolson

12 11 25 / 08:38 AMIf you're running an exchange and you don't see E3 as a lifeline, you're not thinking ahead. This isn't about being ‘corporate’-it's about survival. The EU isn't playing around. MiCA is coming. Your users want to trade without fear of getting fined out of existence. E3 gives you that peace of mind. And yes, it's expensive-but so is shutting down.

Anthony Allen

13 11 25 / 16:47 PMAnyone who’s ever tried to integrate a compliance platform knows how painful this stuff is. The API docs are a mess, the false positives are insane, and you need a compliance officer just to read the dashboard. But honestly? I’d rather deal with this than get raided by FinCEN. E3’s not perfect-but it’s the least terrible option.

Megan Peeples

14 11 25 / 11:36 AMThey say E3 cuts implementation time by 40%? That’s only because they’ve trained their entire sales team to lie to small exchanges. My company spent 11 weeks and $8,000 in overages just to get the transaction mapping right. And don’t even get me started on the ‘MiCA Complete Package’-it’s just the basic plan with a fancy label and a $2,000 markup.

Sarah Scheerlinck

15 11 25 / 06:07 AMI work in compliance for a mid-sized exchange. We switched to E3 last year. The first month was chaos. The second month, we caught a $1.2M wash trading scheme because their ML flagged a pattern we missed. We didn’t have to report it ourselves-they auto-filed it. That’s not magic. That’s just good engineering. I’m not saying it’s perfect. But it saved us.

karan thakur

16 11 25 / 05:19 AMOf course E3 is a front. The same people who run these ‘compliance’ platforms are the same ones pushing for global surveillance under the guise of ‘anti-money laundering.’ They want to track every Satoshi. They want to know who you’re sending money to. They want to shut down privacy coins. This isn’t compliance-it’s control. And you’re paying for it.

Evan Koehne

17 11 25 / 04:03 AMSo E3 is the ‘health inspector’ for crypto exchanges? Funny. Last time I checked, health inspectors didn’t charge $15,000/month to check if the kitchen was clean. They just showed up, gave a thumbs up or down, and moved on. But here? We pay for a five-star Yelp review that says ‘your kitchen is clean… but only if you buy our $3,500/month sanitizing spray.’

Vipul dhingra

18 11 25 / 22:40 PME3 is just another middleman trying to profit off the regulatory mess they helped create. Chainalysis does the same thing but with more hype. The real solution? Decentralized identity on-chain. But no, we'd rather pay for a corporate dashboard that says 'user flagged' 15 times a day because they used a VPN

Jacque Hustead

20 11 25 / 21:23 PMMy exchange used to have 3 people handling KYC manually. Now we have one person checking E3 alerts. We saved 200 hours a month. I know the interface is clunky. I know the false positives suck. But when the regulator calls and asks for audit logs from six months ago, and we hand them a clean PDF in 30 seconds? That’s worth every penny.

Wendy Pickard

20 11 25 / 22:45 PMI’ve seen exchanges get banned for not having proper AML. I’ve seen founders lose everything. E3 isn’t glamorous. It’s not a blockchain revolution. But it’s the reason your favorite exchange is still open. Sometimes the most important tech is the one you never see.

Jeana Albert

22 11 25 / 08:10 AMThey say E3 cuts implementation time? Try telling that to the guy who had to rebuild his entire transaction pipeline because E3 doesn’t support non-standard wallet formats. And then they charge extra for ‘custom mapping.’ That’s not a service-it’s a hostage situation. And don’t get me started on the ‘priority support’-it just means they reply in 48 hours instead of 72.

Natalie Nanee

23 11 25 / 13:48 PMIt’s not about legality-it’s about control. They want you to believe this is safety. But it’s not. It’s about making sure you can’t move money without their permission. They’re not protecting you. They’re protecting the system. And the system doesn’t care about your freedom.

Angie McRoberts

24 11 25 / 00:44 AMLook-I get why people hate this stuff. It’s boring. It’s expensive. It feels like selling out. But if you’re building something real, you don’t get to pick and choose which laws to follow. E3 isn’t the hero. It’s the paperwork. And if you’re lucky, you’ll never need it. But if you do? You’ll be glad it exists.

Chris Hollis

24 11 25 / 14:21 PME3 is a tax on growth. The real innovation is avoiding it.