Crypto Withdrawal Risk Calculator

Assess Your Withdrawal Risk

Input your withdrawal details to see potential bank reactions based on current Indian regulations.

When you try to withdraw cryptocurrency to fiat currency in India, you’re not just making a simple bank transfer. You’re walking into a legal gray zone where the law says one thing, but the banks act like another. Even though owning and trading crypto is legal in India, banks still treat crypto-to-fiat withdrawals like risky, borderline activities. Why? Because the Reserve Bank of India (RBI) hasn’t given them a green light - and they’re scared of the consequences.

Legal? Yes. Bank-Friendly? Not Even Close

The Supreme Court of India overturned the RBI’s 2018 ban on crypto banking services in 2020. That meant banks could legally open accounts for crypto exchanges again. But that didn’t mean they started welcoming crypto customers with open arms. Most banks still avoid it. They don’t outright refuse - they just make it hard. You’ll get delayed transfers, extra paperwork, or worse: your account flagged for “suspicious activity.”

Here’s the reality: if you’re trying to move Bitcoin or Ethereum into your bank account as rupees, the bank doesn’t see a simple sale. They see a transaction with no clear paper trail. Unlike selling stocks or forex, crypto transactions don’t come with a broker statement or exchange receipt that banks recognize. So when your account receives ₹50,000 from an unknown source labeled “crypto withdrawal,” the bank’s fraud system kicks in. And they don’t ask questions - they freeze.

Why Banks Are So Nervous

The RBI has never changed its mind about crypto. Former Governor Shaktikanta Das called it a threat to financial stability. Current Governor Sanjay Malhotra says India should focus on its own digital rupee - the CBDC - not private cryptocurrencies. That’s the official line. And banks listen. They don’t want to be the ones fined or investigated for helping crypto users.

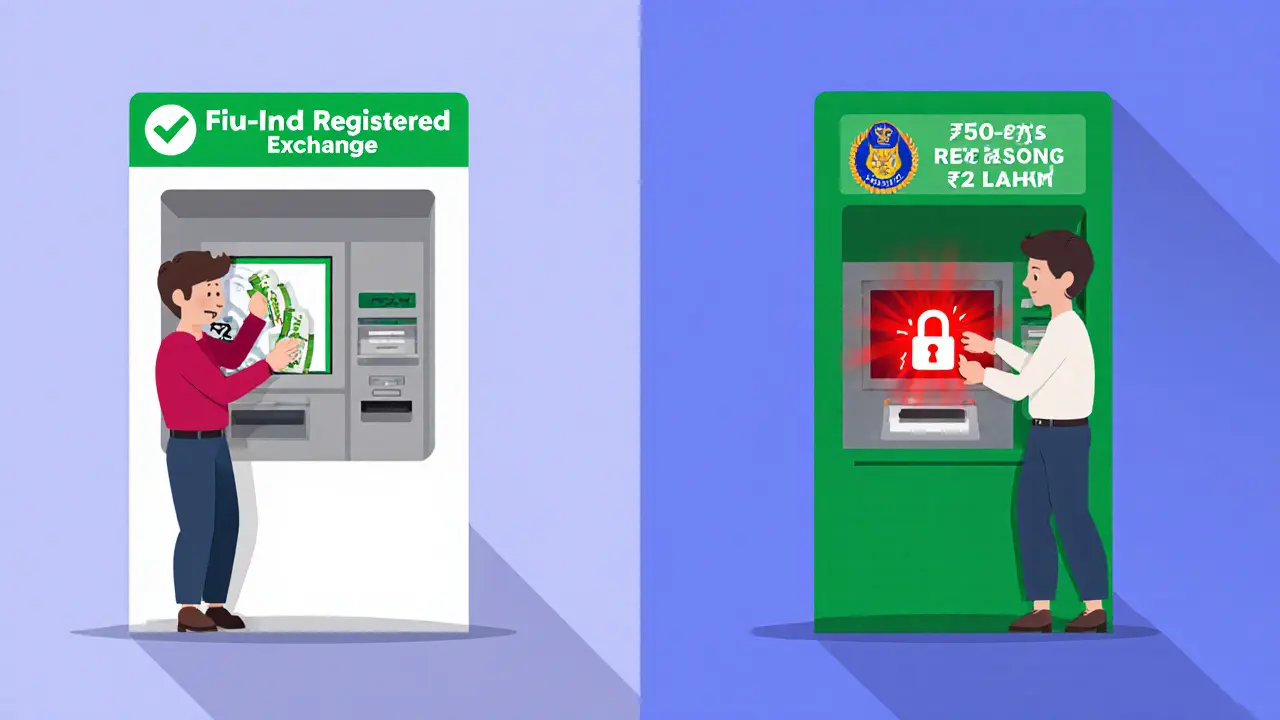

It’s not just about fear. It’s about rules. Since March 2023, every crypto platform in India - even foreign ones serving Indian users - must register with the Financial Intelligence Unit (FIU-IND) under the Prevention of Money Laundering Act. That means exchanges have to collect your ID, proof of address, source of funds, and even your tax details. If they don’t, they get blocked. In 2024, the government forced 25 major crypto exchanges like BingX and LBank to pull their apps from Indian app stores because they skipped registration.

So when you withdraw crypto to fiat, the exchange you’re using must have passed FIU-IND checks. If they haven’t, your withdrawal won’t go through - not because the bank says no, but because the exchange is blocked from sending money to Indian banks at all.

What You Need to Withdraw Crypto to Fiat

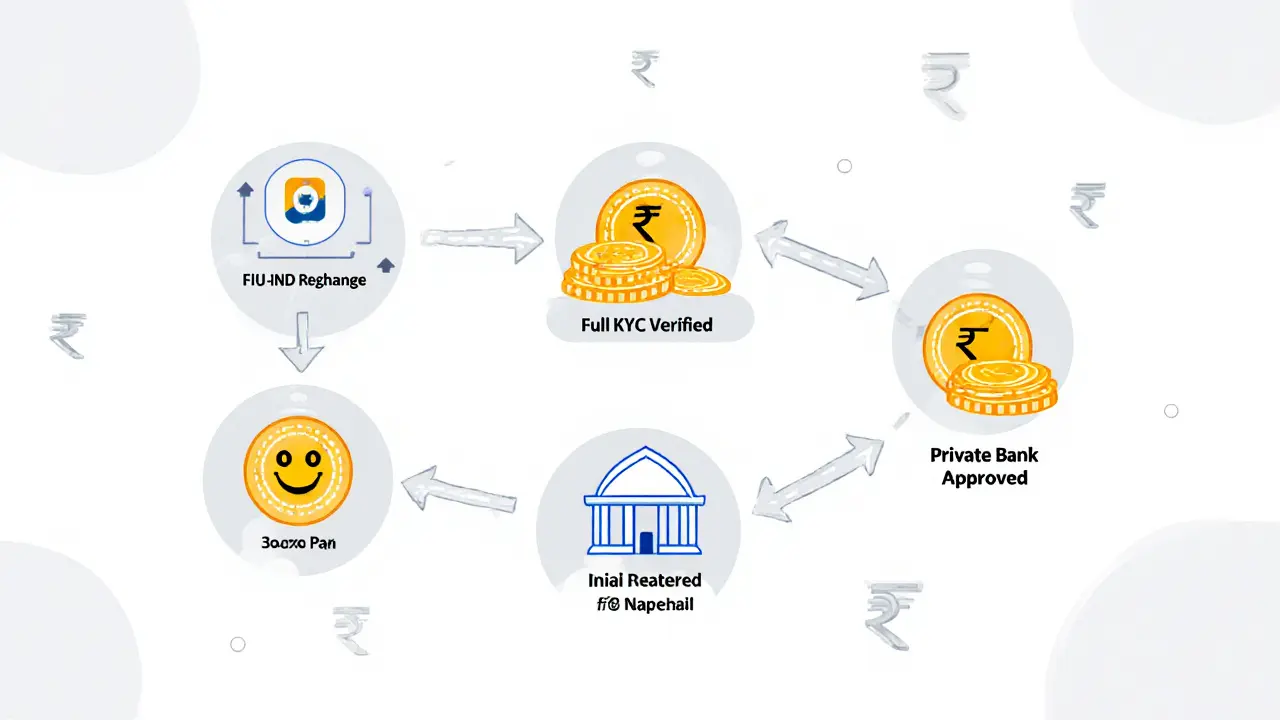

If you want to successfully turn crypto into rupees, you need more than just a wallet. You need a full compliance package:

- Use a registered exchange: Only platforms like WazirX, CoinDCX, or ZebPay that are registered with FIU-IND can legally process fiat withdrawals. Avoid offshore platforms that don’t comply - they’ll block your withdrawal or vanish with your funds.

- Complete full KYC: This isn’t just uploading your Aadhaar. You need to verify your identity, phone, bank account, and sometimes even your employment or income source. Some exchanges ask for six months of bank statements to prove your crypto came from legal earnings.

- Track your taxes: India taxes crypto gains at 30% plus 4% cess. If you don’t report your crypto-to-fiat profits in your income tax return, the Income Tax Department can freeze your bank account. The government cross-checks crypto exchange data with bank transactions. Don’t assume they don’t know - they do.

- Use the right bank: Some banks are more lenient than others. Public sector banks like SBI and PNB tend to be stricter. Private banks like Kotak Mahindra or HDFC are more likely to process crypto withdrawals if the source is clearly documented. But even they’ll ask for explanations.

What Happens If You Get Flagged?

It’s not rare. If your bank sees a large crypto deposit - say ₹2 lakh or more - they’ll call you. They might ask: “Where did this money come from?” “Do you have proof of sale?” “Can you show the transaction ID from the exchange?”

If you can’t answer, your account could be frozen for up to 90 days while they investigate. You’ll need to submit:

- A screenshot of your trade history from the exchange

- A tax filing receipt showing you paid 30% on the gain

- A letter from the exchange confirming the withdrawal was processed under KYC

Without these, you might lose access to your account. And if the bank reports you to FIU-IND for “suspicious transaction,” you could face a formal inquiry - even if you did nothing illegal.

The Bigger Picture: Why This Isn’t Going Away

India isn’t banning crypto. It’s controlling it. The government wants to tax it, track it, and tie it to the formal financial system - not let it run wild. That’s why they’re pushing for new legislation that would put crypto under SEBI’s control, treating it like securities. If passed, this would make exchanges register like stock brokers, and withdrawals would look more like selling shares.

Until then, you’re stuck in the middle. The law says you can own crypto. The banks say they’ll process your withdrawal - but only if you jump through every hoop. The RBI says crypto is dangerous. And the FIU-IND is watching every transaction.

What Works Right Now

Here’s what real users in India are doing in 2025 to get their crypto cash without trouble:

- They withdraw small amounts - under ₹1 lakh - to avoid triggering alerts.

- They wait 2-3 days between withdrawals to avoid patterns that look like money laundering.

- They keep all records: trade receipts, tax filings, exchange confirmations - in one folder, backed up online.

- They avoid using peer-to-peer (P2P) platforms for cashouts. Those are the most likely to get flagged.

- They use only exchanges that display the FIU-IND registration number on their website.

There’s no magic trick. No loophole. Just paperwork, patience, and proof.

What Doesn’t Work

Don’t try these - they’ll get you in trouble:

- Using fake IDs or borrowed bank accounts to withdraw crypto.

- Splitting large withdrawals into smaller ones to dodge detection (this is called “structuring” and is illegal under PMLA).

- Using unregistered offshore exchanges like Binance or KuCoin to send rupees to your account.

- Ignoring tax reporting - the IT department already has your crypto data.

The government isn’t going after small-time users. But they’re going after anyone who tries to hide the trail. If you’re honest, you’re fine. If you’re sneaky, you’re already on their radar.

Final Reality Check

India’s system isn’t broken - it’s intentional. The government wants crypto to exist, but only under strict control. Banks are just following orders. Your job isn’t to fight the system. It’s to navigate it.

If you’re withdrawing crypto to fiat in India, treat it like filing a tax return: be prepared, be accurate, be transparent. The money is yours. But the rules are not.

Can I withdraw crypto to fiat using any bank in India?

No, not all banks accept crypto-related deposits. Public sector banks like SBI and PNB are more likely to block or flag these transactions. Private banks like Kotak Mahindra or HDFC are more tolerant - but only if you provide full documentation like KYC records from the exchange and proof of tax payment. Always check with your bank first.

Is it legal to convert crypto to rupees in India?

Yes, it’s legal to convert crypto to rupees in India. The Supreme Court struck down the RBI’s 2018 ban in 2020. However, you must use a FIU-IND-registered exchange, complete full KYC, and pay 30% tax on capital gains. Failure to comply can lead to account freezes or legal action.

Why do banks freeze accounts after crypto withdrawals?

Banks freeze accounts when they detect unexplained deposits that match patterns of crypto transactions - especially if no source of funds is provided. Since crypto transfers lack traditional documentation, banks treat them as potential money laundering. If you can’t prove the money came from a legal crypto sale with tax paid, they’ll freeze the account until you provide proof.

Do I need to pay tax on crypto-to-fiat withdrawals?

Yes. India taxes all crypto gains at 30% plus 4% cess. You must declare the profit (sale price minus purchase cost) in your annual income tax return. The Income Tax Department receives transaction data from FIU-IND and exchanges, so undeclared gains are easily detected. Failure to pay can result in penalties, interest, or even criminal charges.

Can I use P2P platforms to cash out crypto in India?

Technically yes, but it’s risky. P2P platforms like Binance P2P or CoinSwitch Kuber allow direct trades with individuals. But these transactions often lack proper documentation, making them easy targets for bank fraud systems. Many users report frozen accounts after P2P cashouts. For safety, use only registered exchanges that handle KYC and tax reporting automatically.

What happens if I use an unregistered crypto exchange?

If you use an unregistered exchange - like Binance, Bybit, or KuCoin - your withdrawal to an Indian bank will likely be blocked. Even if the money gets through, the FIU-IND can flag your bank account for “non-compliant transaction.” In 2024-2025, the government ordered 25 offshore exchanges to shut down services to Indian users. Using them puts you at risk of legal scrutiny, even if you’re just cashing out.

Mauricio Picirillo

15 11 25 / 18:15 PMMan, I’ve seen this same vibe in crypto everywhere - banks act like you’re smuggling gold bars in your socks. But hey, at least India’s trying to regulate it instead of just banning it. Kudos to the users who keep it legal and documented. You’re the real MVPs.

Liz Watson

17 11 25 / 06:42 AMOh wow, a country that actually *taxes* crypto? How quaint. In the US, we just pretend it’s barter and hope the IRS doesn’t notice. At least India’s got the guts to say ‘yes, this is income’ - even if their banks are still stuck in 2018.

Rachel Anderson

19 11 25 / 05:09 AMI cried when I read this. Not because I’m emotional - because I’ve been there. My SBI account got frozen for 87 days because I transferred 1.2 lakh from WazirX. They asked for my birth certificate, my dog’s vaccination records, and a signed affidavit from my therapist. I swear, if I had a pet rock, they’d want its birth certificate too.

Hamish Britton

19 11 25 / 08:59 AMIt’s wild how much trust gets eroded when institutions fear what they don’t understand. Banks aren’t evil - they’re just terrified of regulatory fallout. But that fear ends up punishing the honest people. Maybe if regulators and banks talked to actual crypto users instead of lawyers, we’d get somewhere.

Robert Astel

20 11 25 / 13:37 PMSo like, I think the real issue here isn’t the banks or even the RBI, it’s that we’re trying to fit this decentralized, borderless, digital-native thing called crypto into these old, clunky, paper-based, government-run financial systems that were designed for… I don’t know, selling wheat in the 19th century? Like, why are we even surprised it doesn’t fit? It’s like trying to plug a USB-C cable into a floppy drive. The tech just ain’t compatible, man. And also, I think we need more empathy for the bank tellers, they’re just trying to keep their jobs, you know? I mean, imagine being the guy who has to say ‘no’ to someone who just wants to cash out their ETH after a 5x moon. That’s heavy.

Andrew Parker

20 11 25 / 22:00 PMI just… I can’t. 😭 This is the most emotionally taxing thing I’ve ever experienced. I spent 14 months trying to get my crypto cash out of India. I had to submit 37 forms. I cried in the bank lobby. I prayed to Satoshi. And still, they froze my account. I’m not even mad anymore. I’m just… empty. 💔 But hey - at least I paid my 30% tax. That’s something, right? Right? 🙏

Kevin Hayes

22 11 25 / 21:13 PMThe systemic tension here reflects a broader epistemological conflict: between emergent decentralized value systems and centralized institutional epistemic authority. Banks operate under a paradigm of traceable, auditable, and regulated flows - crypto, by design, resists this. The RBI’s caution is not irrational; it is conservative institutional logic. But the legal ambiguity creates moral hazard: users are forced into compliance theater, not because the activity is illicit, but because the infrastructure lacks interoperability. This is not a failure of individuals - it is a failure of institutional adaptation.

Katherine Wagner

23 11 25 / 16:10 PMI mean, why do banks even care? Like, it's money. It's just numbers. But then again, maybe they're scared of the IRS. Or maybe they just don't want to do extra work. Or maybe they're all just robots programmed by the Fed. Who knows. Anyway, I used Binance P2P and my account got flagged. So I just opened a new one. Easy.

ratheesh chandran

25 11 25 / 11:49 AMBro, I am from Mumbai and I tried to withdraw 2 lakh from CoinDCX and my account got frozen for 6 weeks. I had to go to the branch with my Aadhaar, PAN, trade screenshots, tax return, and even a selfie holding a newspaper. They asked me if I was a drug dealer. I said no, I’m a software engineer. They said ‘then why you have so much crypto?’ I said ‘because I’m smart.’ They didn’t believe me. Now I use Kotak. They’re better. But still, every time I deposit, I get a call. I hate this system. India is so bureaucratic. I miss the days when crypto was free.

Hannah Kleyn

25 11 25 / 18:16 PMIt’s funny how the same people who scream about financial freedom when it comes to crypto suddenly get really quiet when the bank asks for proof of income. I’ve been watching this whole thing from the sidelines - and honestly, the users who succeed aren’t the ones with the biggest wallets. They’re the ones with the most patience and the most organized Google Drive folders. I’m just waiting for the day someone automates this whole process with a bot. Until then, I’ll keep my receipts in a folder called ‘Crypto Survival Guide v12’.

gary buena

26 11 25 / 20:52 PMMan, I tried using Binance P2P to cash out and my bank flagged it as ‘high risk’ - turns out the guy I traded with had used a fake ID. So now I’m stuck with 0.3 BTC and a bank account on probation. I’m not mad, just… disappointed. Like, we’re all trying to do the right thing here. Why does it feel like the system is rigged against us? 😅

Vanshika Bahiya

28 11 25 / 06:14 AMHi everyone! I’m Vanshika, a crypto tax consultant in Delhi. If you’re withdrawing crypto in India, please don’t panic. The system is frustrating, yes - but it’s NOT impossible. I’ve helped over 200 people get their funds released. The key? Start small. Use only FIU-registered exchanges. Keep EVERYTHING: trade history, tax receipts, exchange confirmations. Save them in PDFs with clear filenames like ‘WazirX_Sale_2024-12-05_TaxPaid.pdf’. And if your bank calls? Answer. Calmly. Politely. Say: ‘This is from a registered exchange, I’ve paid 30% tax, here’s my Form 26AS.’ Most banks will back down. You’re not doing anything wrong. You’re just navigating a messy system. You’ve got this 💪

Albert Melkonian

29 11 25 / 13:45 PMIt is imperative to recognize that the regulatory framework in India, while burdensome, represents a pragmatic attempt to integrate an emergent asset class into a formal financial ecosystem. The institutions involved are not inherently hostile; they are operating under a legal mandate to mitigate systemic risk. The onus is on the individual to ensure compliance, not to circumvent it. One must approach this not as a battle against authority, but as a necessary act of financial citizenship. The integrity of the system depends on transparency, not resistance.

Kelly McSwiggan

1 12 25 / 00:50 AMOh wow, so we’re supposed to be grateful that India doesn’t just arrest us for owning crypto? That’s like being happy you weren’t executed for jaywalking. The 30% tax? The FIU-IND surveillance? The bank interrogations? This isn’t regulation - it’s financial harassment dressed up as policy. And the fact that people are calling this ‘workable’ is the most depressing thing I’ve read all week. Congrats, India. You turned crypto into a paperwork nightmare with extra steps.

Byron Kelleher

2 12 25 / 21:21 PMJust wanted to say - if you’re reading this and you’re stressed about your crypto withdrawal, you’re not alone. I’ve been there. I’ve had my account frozen. I’ve cried over spreadsheets. But I also got through it. Slowly. With patience. And a lot of coffee. You don’t need to fight the system. Just learn how to move with it. You’re doing better than you think. Keep going. 💙