Bitcoin Mining Difficulty Calculator

How Bitcoin Difficulty Adjusts

Every 2,016 blocks (≈14 days), Bitcoin adjusts mining difficulty based on actual block production time. The target is 20,160 minutes (2,016 blocks × 10 minutes). If blocks were mined faster than 10 minutes, difficulty increases. If slower, difficulty decreases.

New Difficulty = Old Difficulty × (Actual Time / Target Time)

Calculate Your Adjustment

Result

Adjustment Limit Applied

Difficulty can only change by ±4x per adjustment. Your calculation exceeded this limit.

This adjustment is based on the actual time it took to mine the last 2,016 blocks. Bitcoin uses a 4x cap to prevent extreme volatility: maximum 300% increase or 75% decrease per adjustment.

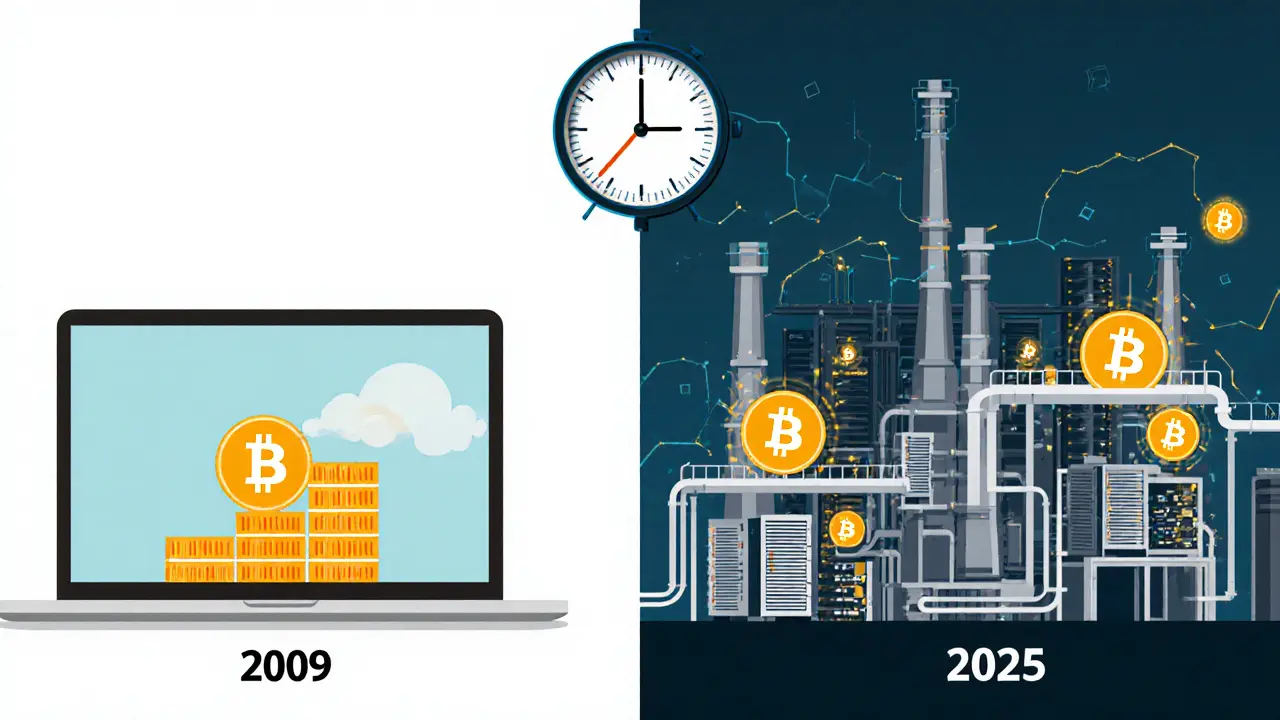

When Bitcoin first launched in 2009, mining a block was easy. A regular laptop could find the solution in minutes. Today, it takes a room full of specialized machines, using more power than some small countries, to do the same job. What changed? Not the rules of Bitcoin - but the mining difficulty. This invisible force adjusts automatically, every two weeks, to keep Bitcoin’s block time locked at 10 minutes. Without it, the network would either grind to a halt or explode with blocks, breaking its core promise: steady, predictable, secure transactions.

Why Mining Difficulty Exists

Bitcoin was designed to produce one block every 10 minutes, no matter what. That’s not arbitrary. Ten minutes gives enough time for nodes across the globe to confirm and propagate new blocks, preventing chain splits and double-spends. But what happens when thousands of new miners join? Or when a new ASIC chip cuts mining time in half? Without adjustment, blocks would flood out every few seconds. That’s chaos. Too few miners? Blocks could take hours. That’s useless. Mining difficulty solves this. It’s a self-correcting dial that makes the math harder or easier depending on how much computing power is chasing the next block. It’s not a human decision. It’s code. And it runs the same way today as it did in 2009 - with one small, accidental flaw that still hasn’t been fixed.The Math Behind the Adjustment

Every 2,016 blocks - roughly every 14 days - Bitcoin checks how long it took to mine those blocks. The ideal time? 20,160 minutes (2,016 blocks × 10 minutes). If it took 18,000 minutes, the network was too fast. Difficulty goes up. If it took 24,000 minutes, it was too slow. Difficulty goes down. The formula is simple: New Difficulty = Old Difficulty × (Actual Time / Target Time). But here’s the twist: Bitcoin doesn’t use 2,016 blocks. It uses 2,015. A bug from the original code. No one fixed it because it doesn’t break anything. The math still works. The network still adjusts. It’s just not perfectly clean. The actual target isn’t a number you type in. It’s a 256-bit hash value. The lower the target, the harder the puzzle. Think of it like trying to guess a 20-digit number. If the target is 0000000000000000000000000000000000000000000000000000000000000000, you need a near-perfect guess. If the target is 0000000000000000000000000000000000000000000000000000000000000000, you only need a 15-digit guess. Lower target = harder to find.Hard Caps: The 4x Rule

Bitcoin doesn’t let difficulty swing wildly. There’s a safety lock: no more than a 4x increase or 4x decrease in a single adjustment. That means:- Difficulty can rise by at most 300% - from 100 to 400

- Difficulty can fall by at most 75% - from 100 to 25

How It Affects Miners - Real Numbers

Difficulty isn’t abstract. It’s money. Every miner runs a cost-benefit calculation: Will I make more than I spend on electricity and hardware? Let’s say you’re running an older ASIC miner that costs $0.05 per kWh. Your daily output is 0.0005 BTC. If difficulty jumps 20%, your output drops to 0.0004 BTC. Your profit shrinks. If your electricity cost is $0.10/kWh, you’re now losing money. You have to shut down - or upgrade. In July 2021, Bitcoin’s difficulty spiked 27.94% in one adjustment. Thousands of home miners with outdated equipment were instantly unprofitable. Some sold their rigs for scrap. Others took out loans to buy new machines. Mining pools saw a rush of miners switching between pools, hoping for better payout timing. Professional miners plan for this. They don’t buy gear that barely breaks even. They aim for 15-20% profit margin above electricity cost. That buffer lets them ride out a 20-30% difficulty spike without shutting down. It’s survival.Hash Rate vs. Difficulty - The Feedback Loop

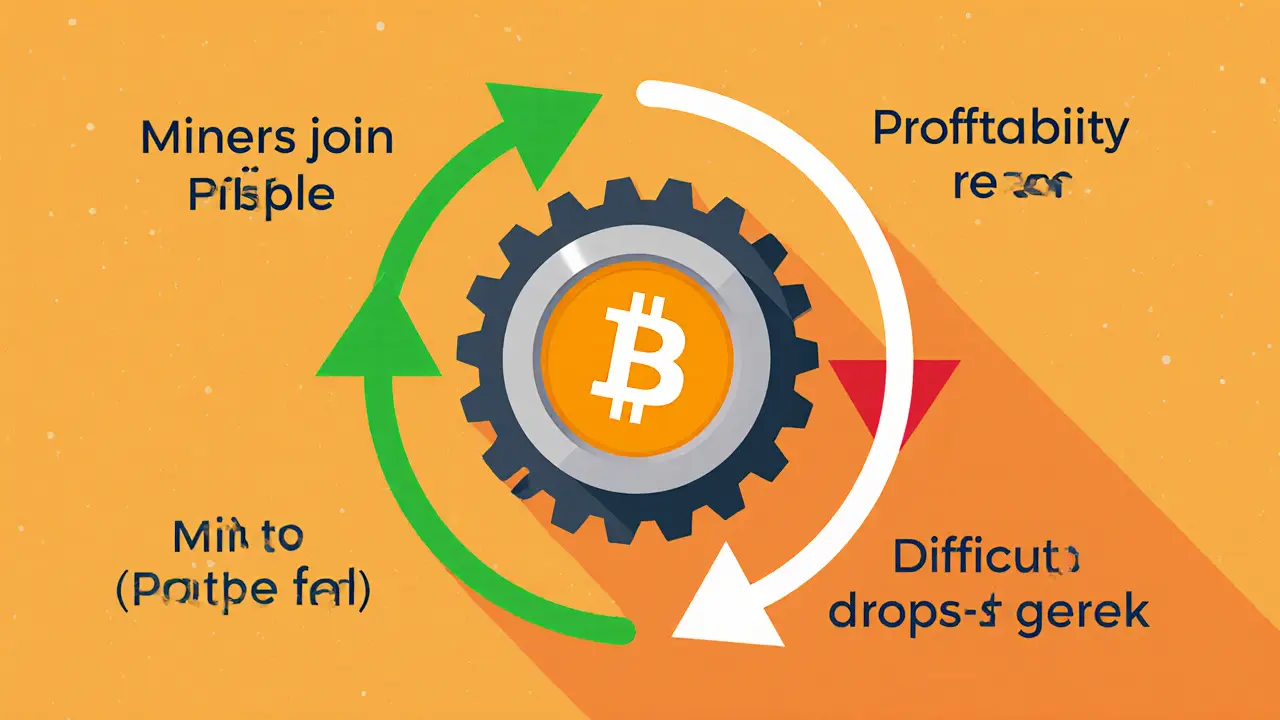

Difficulty doesn’t just react - it shapes behavior. When difficulty drops, profitability rises. More miners join. Hash rate climbs. Difficulty rises again. When difficulty spikes, miners leave. Hash rate falls. Difficulty drops. It’s a natural market cycle. This is why Bitcoin’s security grows stronger over time. As more computing power joins, it becomes exponentially harder for any single entity to control 51% of the network. A 51% attack on Bitcoin today would cost billions - and likely fail. That’s the direct result of rising difficulty. But here’s the catch: difficulty doesn’t care about Bitcoin’s price. If BTC crashes to $20,000 and miners can’t cover costs, they shut down. Difficulty falls. But if BTC rebounds to $70,000, miners return - and difficulty surges again. The two are linked, but not the same. Profitability depends on both difficulty and price.

How Other Coins Compare

Bitcoin’s 14-day cycle is slow. Litecoin adjusts every 3.5 days. Ethereum (before switching to Proof of Stake) adjusted every block. Some altcoins adjust every single block. Faster adjustments mean quicker responsiveness - but more volatility. Bitcoin chose stability over speed. It’s a philosophical choice. Bitcoin’s approach is conservative. It doesn’t chase efficiency. It chases reliability. That’s why, even with 400+ exahashes of computing power, the network still runs on the same algorithm it did in 2009. It doesn’t need to change. It just needs to keep adjusting.What Miners Need to Watch

If you’re mining - even as a hobbyist - you need to track three things:- Current difficulty - Check sites like Blockchain.com or BitInfoCharts. Difficulty changes every 2,016 blocks. Mark the date.

- Network hash rate - Rising hash rate means difficulty is likely to rise soon. Use this to predict your next profitability drop.

- Electricity cost - Your break-even point is everything. If your power bill is $0.12/kWh and your miner’s efficiency is 30 J/TH, you’re already in danger when difficulty climbs above 50 trillion.

Where Difficulty Is Headed

Since Bitcoin’s launch, difficulty has increased by over 50 million percent. That’s not growth. That’s a revolution in computing power. In 2009, a CPU could mine. In 2025, you need custom silicon chips, liquid cooling, and industrial power contracts. The next phase? Efficiency plateaus. ASIC manufacturers are hitting physical limits. Moore’s Law is slowing. New chips won’t double performance every 18 months. That means difficulty will still rise - but slower. More institutional players will enter, bringing stable, long-term capital. Smaller miners will struggle to compete unless they have access to cheap, renewable energy. The bottom line: mining difficulty isn’t just a technical detail. It’s the heartbeat of Bitcoin’s economic model. It keeps the network secure. It rewards efficiency. It punishes waste. And it’s the reason Bitcoin still works - after 16 years, billions of transactions, and trillions in market value.If you’re thinking about mining, understand this: you’re not just buying hardware. You’re betting on the next difficulty adjustment. And that’s a gamble only those who understand the math can win.

How often is Bitcoin mining difficulty adjusted?

Bitcoin mining difficulty adjusts every 2,016 blocks, which typically happens every 14 days. This is based on the time it took to mine the previous 2,016 blocks. The network calculates whether the average block time was faster or slower than 10 minutes and adjusts difficulty accordingly to keep block production steady.

What happens if mining difficulty drops too low?

If difficulty drops too low, blocks would be mined too quickly - potentially every few seconds. This could overwhelm the network with too many blocks, making it harder for nodes to synchronize and increasing the risk of chain forks. Bitcoin prevents this by limiting difficulty decreases to 75% in one adjustment. This ensures stability even if miners suddenly leave the network.

Can mining difficulty be manipulated by miners?

No, difficulty cannot be manipulated by miners. The adjustment is fully automated and based on the actual time it took to mine the previous 2,016 blocks. Even if a group of miners tried to delay block production to lower difficulty, the network’s 4x cap prevents extreme swings. Plus, miners have no incentive to reduce difficulty - lower difficulty means more competition, not less. The system is designed to be self-correcting and resistant to gaming.

Why does difficulty increase when Bitcoin’s price goes up?

Higher Bitcoin prices make mining more profitable. That attracts more miners and more computing power to the network. As more hash power joins, blocks are found faster than every 10 minutes. The network responds by increasing difficulty to slow mining back down to the target time. It’s not the price itself that causes the change - it’s the increased mining activity that follows the price rise.

Is mining still worth it with high difficulty?

Mining is only worth it if your electricity cost is low and your hardware is efficient. With difficulty at record highs, consumer-grade GPUs and old ASICs are no longer profitable. Successful miners today use the latest ASICs, access cheap renewable energy (often under $0.04/kWh), and operate at scale. For most individuals, mining is no longer viable unless they have access to near-zero-cost power.

Ella Davies

16 11 25 / 02:28 AMIt's wild how something so technical ends up being the backbone of an entire economic system. The 14-day cycle feels almost poetic - like nature’s rhythm coded into blockchain. No drama, no panic, just math doing its job. I love that it doesn’t care about headlines or tweets.

Henry Lu

16 11 25 / 17:14 PMbro the 2015 block bug is still alive?? lmao. bitcoin devs are like ‘eh its fine’ while the rest of us are out here optimizing our ASICs. this is why crypto will never be enterprise grade. 10/10 chaos engineering.

nikhil .m445

16 11 25 / 18:50 PMActually, I must correct you. In India, we have miners who use solar power and still make profit. You must understand that mining is not only about hardware but also about energy access. In rural areas, we use excess power during monsoon season. This is not possible in your country because of regulation.

Barbara Kiss

18 11 25 / 15:43 PMDifficulty isn't just a number - it's the silent conductor of a global symphony of silicon and electricity. Every adjustment is a quiet rebalancing of human ambition, greed, hope, and engineering. The fact that it’s automated makes it sacred. No king, no CEO, no Fed chair gets to touch it. It just… is. That’s the beauty of decentralized trust.

Carol Wyss

19 11 25 / 14:45 PMFor anyone new to mining: don’t start unless you’ve calculated your break-even point with your actual electricity bill. I saw so many people buy a used Antminer S19 last year thinking they’d get rich. They didn’t even cover the power cost. It’s not a lottery - it’s a business. Be honest with yourself first.

Mike Gransky

20 11 25 / 22:33 PMOne thing people forget - difficulty doesn’t just protect the network, it protects miners too. Without the 4x cap, you could have a 10x drop after a major shutdown, then a sudden price spike, and suddenly everyone’s flooded with cheap rigs trying to grab rewards. That’s not stability. That’s a casino. Bitcoin’s slow, cautious adjustments are what make it resilient. It’s not sexy, but it’s wise.

Nataly Soares da Mota

22 11 25 / 08:36 AMThe feedback loop between hash rate and difficulty is the closest thing crypto has to a Darwinian algorithm. Miners are the organisms. Electricity is the environment. ASICs are the mutations. The ones that don’t adapt get purged. The ones that do? They become the new baseline. It’s not just mining - it’s evolution, with heat sinks instead of fur.

Teresa Duffy

22 11 25 / 11:16 AMIf you’re thinking about mining, stop. Just stop. Unless you have access to $0.03/kWh and a warehouse full of S21s, you’re not a miner - you’re a donor to Bitmain. Go buy BTC instead. Save your sanity, your electricity bill, and your dignity.

Bruce Murray

22 11 25 / 11:54 AMEven with all the complexity, I still find it beautiful that Bitcoin’s core mechanism hasn’t changed since 2009. It’s like a grandfather clock ticking away in a world of smartphones. No upgrades. No patches. Just the same quiet math, doing the same vital work. That’s integrity.

Ninad Mulay

23 11 25 / 05:08 AMHere in India, we joke that Bitcoin mining is the new chai wallah. Everyone’s got a rig in the back room. Some are running on stolen power. Some are running on solar. But they all know one thing - if difficulty spikes, you either upgrade or go back to selling tea. It’s survival, not speculation.

Ryan Hansen

24 11 25 / 10:33 AMLet’s talk about the real elephant in the room - the 2016 block bug. It’s not just a quirk. It’s a cultural artifact. The original code had a off-by-one error in the adjustment calculation, and instead of fixing it, Satoshi left it because it worked. That’s the soul of Bitcoin right there - functional over perfect. It’s like leaving a loose screw in a spaceship because the engine still runs. Most engineers would panic. Bitcoin just shrugs and keeps mining. That’s why it lasts. It doesn’t care about clean code. It cares about continuity.

Sean Pollock

26 11 25 / 06:41 AMyou think the 4x cap is safe? think again. what if a nation state floods the network with subsidized rigs? they dont need to profit - they just need to crash the network. the cap is a myth. the real security is the price. if btc crashes, miners leave, difficulty drops, and then boom - the same actors come back with cheap rigs and take over. its all a game of chicken. and we’re all just spectators.

Student Teacher

27 11 25 / 15:38 PMCan someone explain why difficulty increases even when BTC price is flat? I thought it was all about profit. But I saw a 12% spike last month when BTC was stuck at $60k. Why?

Lori Holton

27 11 25 / 20:35 PMLet’s be honest - the entire system is a controlled demolition. The ‘self-correcting’ difficulty is just a way to redistribute wealth from small miners to institutional players who can afford to wait out the 14-day lag. They buy hardware during dips, sit on it, then flood the network when difficulty is low. It’s not decentralization. It’s oligarchy with ASICs.

Aryan Juned

29 11 25 / 19:01 PMbro the fact that we’re still using the same math from 2009 is like driving a 1987 Honda Civic with a rocket engine. it works… but why?? 🤯🤯🤯

Derayne Stegall

30 11 25 / 10:41 AMMINING ISN’T DEAD - IT’S JUST BECOMING A SPORT FOR THE RICH 😎🔥. if you got cheap power, go for it. if not? buy btc and chill. your laptop will thank you 🙏

Jay Davies

2 12 25 / 07:19 AMThere is a persistent misconception that difficulty is directly correlated with Bitcoin’s price. This is incorrect. Difficulty responds solely to hash rate, which is a function of miner profitability, which is influenced by price, but not determined by it. The causal chain is often misattributed in popular discourse.

Grace Craig

2 12 25 / 09:07 AMThe elegance of Bitcoin’s difficulty adjustment lies in its mathematical purity - a self-referential system that requires no external governance, no central authority, no committee votes. It is the purest form of emergent order in digital systems. The 2015-block anomaly is not a bug; it is a testament to the system’s resilience. A flaw that refuses to be fixed because it is unnecessary - that is true engineering wisdom.

Rick Mendoza

3 12 25 / 18:10 PMyou guys are overthinking this. difficulty goes up = more hash = more security. that's it. stop with the poetry. it's just math. if you can't run an S21 at $0.05/kwh you shouldn't be here. simple.

Mike Gransky

5 12 25 / 16:24 PMReplying to @1126 - Difficulty increases even when price is flat because miners are still incentivized by future expectations. If you believe BTC will go up in 3 months, you keep mining even at break-even now. Also, institutional miners operate on long-term contracts and don’t shut down for short-term dips. So hash rate keeps climbing even if price stalls - and difficulty follows. It’s not about today’s profit. It’s about tomorrow’s dominance.