Most crypto users think of decentralized exchanges as places to trade Bitcoin for Ethereum, or SOL for Shiba Inu. But what if you just want to swap USDC for USDT - fast, cheap, and without losing 1% to slippage? That’s where Saber DEX comes in. It doesn’t try to be everything. It’s built for one thing: stablecoin swaps on Solana. And for that job, it’s one of the best tools you’ll find.

What Is Saber DEX?

Saber is a decentralized exchange built directly on Solana. Unlike Uniswap or PancakeSwap, which let you trade thousands of tokens, Saber only supports stablecoins and wrapped versions of them - like wUSDC, wUSDT, sbtc, and EURS. It doesn’t trade SOL, ETH, or any volatile assets. That’s not a bug. It’s the whole point.

Launched in 2021 by former Coinbase and Chainlink engineers, Saber was designed to fix a real problem: stablecoin swaps on Ethereum were slow and expensive. A $50,000 USDC-to-USDT trade on Curve could cost $10 in fees and take 15 seconds. On Saber, the same trade costs $0.00025 and finishes in under half a second.

The secret? Saber uses a custom automated market maker called StableSwap. It’s optimized for assets that are meant to stay at $1.00. Instead of letting prices swing wildly like Uniswap does, Saber’s algorithm keeps the price tight between $0.9997 and $1.0003. That means you get near-zero slippage even on large trades.

How Saber Works: Speed, Cost, and Capital Efficiency

Saber runs on Solana, which processes about 65,000 transactions per second. That’s why swaps happen in 400 milliseconds - faster than your phone loads a webpage. Ethereum-based DEXs? They’re lucky to hit 15 seconds during normal times.

Transaction fees on Saber? You pay only what Solana charges: roughly $0.00025 per trade. That’s 4,000 times cheaper than Ethereum’s average $1.50 fee. You don’t pay Saber anything extra. The protocol takes a 0.04% trading fee, but that goes straight to liquidity providers, not to a company wallet.

Here’s the kicker: Saber’s liquidity pools are 95-98% efficient. That means almost every dollar in the pool is actively used for trading. On regular AMMs like Uniswap, you might only get 70-80% efficiency because the algorithm has to cover price swings. Saber doesn’t need that buffer. Stablecoins don’t swing.

That efficiency lets Saber handle big trades with almost no price impact. A $100,000 swap between USDC and USDT on Saber has about 0.04% slippage. On Uniswap, it’d be closer to 0.3% - meaning you’d lose $300 instead of $40.

What You Can Trade on Saber

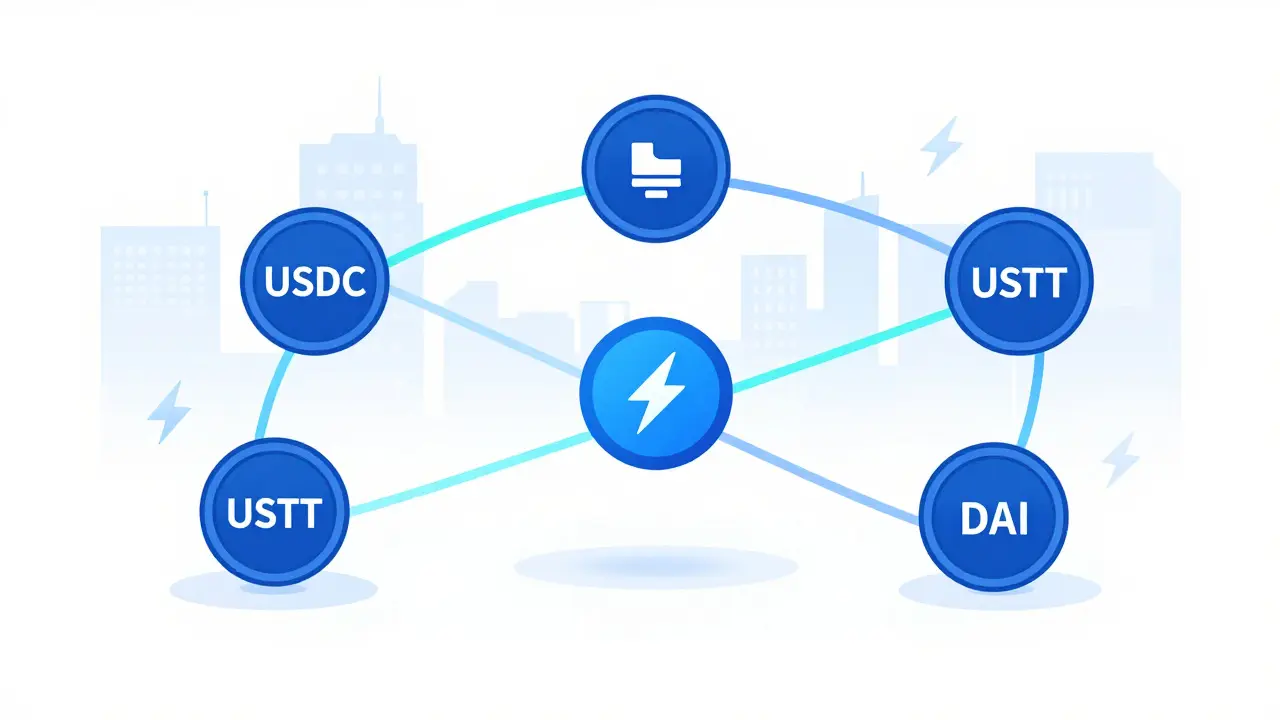

As of late 2025, Saber supports around 85 trading pairs. All of them involve stablecoins:

- USDC ↔ USDT

- USDC ↔ DAI

- USDT ↔ FRAX

- wUSDC (Ethereum) ↔ USDC (Solana)

- sbtc (wrapped Bitcoin) ↔ wUSDC

- EURS ↔ USDC

You can swap stablecoins from other chains using bridges like Wormhole and Allbridge. That means you can bring your Ethereum-based USDC onto Solana and trade it for Solana-native USDT - all in one step.

But here’s the catch: you can’t trade USDC for SOL. You can’t trade USDT for a meme coin. You can’t even trade USDC for a gold-backed token unless it’s wrapped and pegged. If you’re looking to do anything beyond stablecoin swaps, Saber won’t help you.

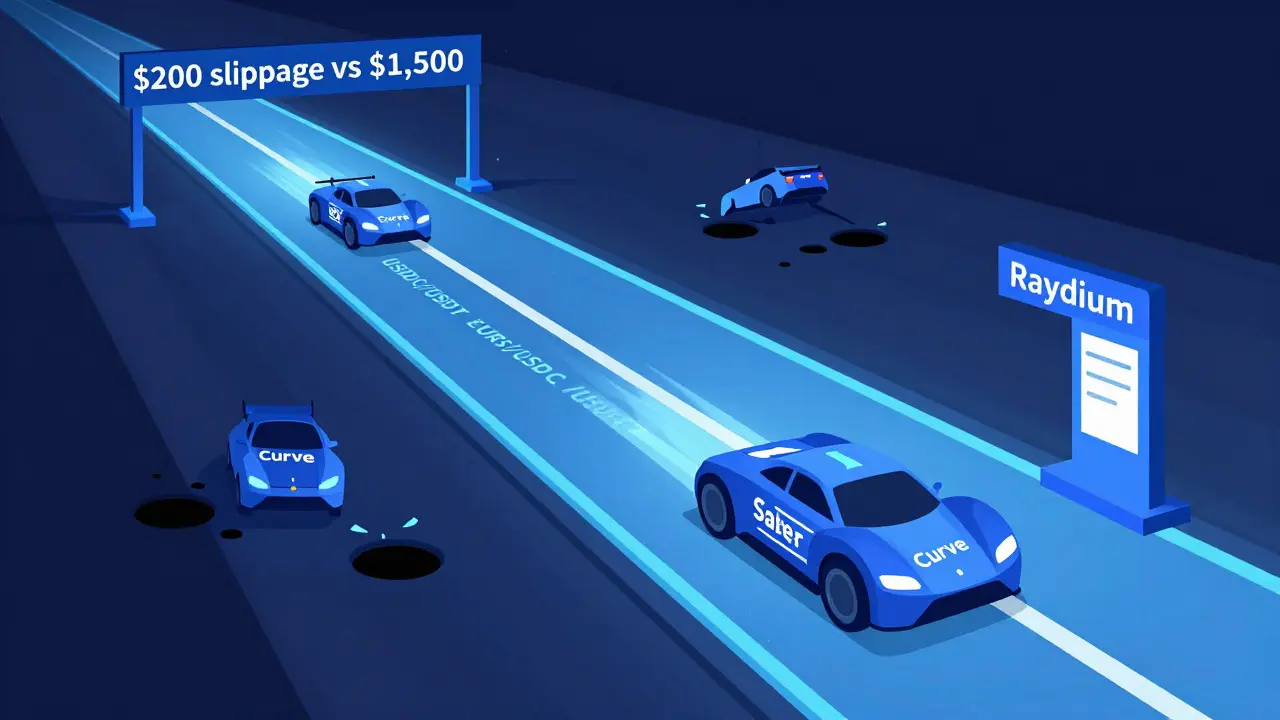

Saber vs. Curve Finance vs. Raydium

Who else does this? Curve Finance is the giant on Ethereum, with over $4 billion locked in stablecoin pools. But Curve’s fees are higher, and trades take longer. Saber wins on speed and cost.

Raydium is another Solana DEX, but it supports over 2,000 token pairs - including SOL, ETH, and random tokens. It’s more versatile, but its slippage on stablecoin swaps is 3-5 times higher than Saber’s. If you’re moving $500,000 in USDC, Raydium might cost you $1,500 in slippage. Saber? $200.

Here’s a quick comparison:

| Feature | Saber DEX | Curve Finance | Raydium |

|---|---|---|---|

| Blockchain | Solana | Ethereum | Solana |

| Trade Speed | 400ms | 15+ seconds | 800ms |

| Swap Fee | 0.04% | 0.04% | 0.2% |

| Slippage (on $100k) | 0.04% | 0.08% | 0.2% |

| TVL (Nov 2025) | $287M | $4.1B | $782M |

| Asset Pairs | 85 (stable only) | 120+ (stable only) | 2,000+ (all types) |

Saber isn’t the biggest. But for pure stablecoin swaps, it’s the fastest and cheapest on Solana.

Who Uses Saber?

It’s not for casual traders. It’s for people moving large amounts of stablecoins:

- DeFi yield farmers who need to shift between stablecoin pools without losing value

- Arbitrageurs exploiting tiny price differences between USDC on Solana vs. Ethereum

- Institutional treasuries managing cash reserves in crypto

- Cross-chain traders moving assets from Ethereum, Polygon, or Avalanche to Solana

According to Nansen, 63% of Saber’s daily users are professional traders. Reddit users praise it for saving them thousands on large swaps. One trader wrote: “I moved $500k from USDC to USDT on Saber. Slippage was $18. On Ethereum, it would’ve been $1,500.”

But if you’re just buying SOL with USDT, Saber won’t help. You’ll need Raydium or Jupiter.

How to Use Saber

Using Saber is simple:

- Get a Solana wallet: Phantom, Solflare, or Backpack.

- Buy at least 0.01 SOL ($0.50) for transaction fees. You need SOL even to trade stablecoins.

- Deposit stablecoins into your wallet - either native Solana tokens or wrapped versions from other chains.

- Go to saber.so and connect your wallet.

- Select your input and output stablecoin (e.g., USDC → USDT).

- Click Swap. Done in under a second.

Adding liquidity? You can deposit two stablecoins into a pool and earn 0.04% of every trade in that pair. No impermanent loss risk - because the prices don’t move.

Don’t be fooled by the simple interface. The backend is complex, but you don’t need to understand it. Just swap.

Problems and Risks

Saber is powerful - but it’s fragile.

Single-chain risk: Saber lives on Solana. If Solana goes down - which it has, six times in 2024-2025 - Saber goes down too. Total downtime in 2024-2025? 28 hours. That’s 28 hours you can’t move your money.

No volatile pairs: If you want to buy a new token after swapping stablecoins, you’ll have to switch to another DEX. It’s a hassle.

Wrapped assets are risky: When you trade wUSDC or sbtc, you’re trusting bridges like Wormhole. There have been exploits on these bridges before. Saber doesn’t control them.

Low user adoption: Only 18% of SBR token holders vote on governance. The protocol is growing, but the community is small. That means less decentralization.

And yes - you still need to understand SOL fees. Many new users get confused: “I’m trading stablecoins, why do I need SOL?” It’s not intuitive.

Future of Saber

Saber V3, launched in September 2025, lets you pool up to 8 stablecoins in one liquidity pool. That’s a big upgrade. It means more capital efficiency and better yields for providers.

The roadmap includes integration with Firedancer - Solana’s next-gen validator software - which could push transaction speed to 1.2 million per second by early 2026. That’s faster than Visa.

There’s debate in the community about adding non-USD stablecoins like EURS or gold-backed tokens. A recent vote showed 54% of veSBR holders opposed it. Saber’s team says they’ll stay focused. “We’re not here to be everything,” said one developer in a Discord AMA. “We’re here to be the best at one thing.”

Analysts predict Saber’s TVL could hit $450-600 million by end of 2026 - if Solana stays strong. But if Ethereum L2s like Arbitrum get cheaper and faster, Saber’s edge could shrink.

Final Verdict

Saber DEX isn’t for everyone. If you trade meme coins, NFTs, or new tokens - skip it. Use Jupiter or Raydium.

But if you move large amounts of stablecoins - whether you’re a trader, a fund, or just someone who hates losing money to slippage - Saber is the best tool on Solana. It’s fast. It’s cheap. It’s precise. And it does one thing better than anyone else.

Think of it like a race car. It won’t take you camping. It won’t haul groceries. But on a track? No one else comes close.

Is Saber DEX safe to use?

Saber is non-custodial, meaning you always control your funds. But it runs entirely on Solana, which has had six major outages since 2024. If Solana goes down, you can’t access Saber. Also, when you trade wrapped tokens like wUSDC, you rely on third-party bridges like Wormhole - which have been hacked before. Use Saber for stablecoin swaps, not long-term storage.

Do I need SOL to use Saber?

Yes. Even though you’re trading stablecoins, Solana charges transaction fees in SOL. You need at least 0.01 SOL ($0.50) in your wallet to pay for swaps. You can’t use USDC or USDT to pay for fees.

Can I swap USDC for SOL on Saber?

No. Saber only supports stablecoin and wrapped stablecoin pairs. You cannot trade any volatile assets like SOL, ETH, or BTC directly. You’ll need to use another DEX like Raydium or Jupiter after swapping stablecoins.

How does Saber make money?

Saber doesn’t charge users directly. It takes a 0.04% fee on every trade, but that fee goes entirely to liquidity providers. The protocol’s native token, SBR, is used for governance - not revenue. There’s no company taking a cut. It’s a community-run protocol.

What’s the difference between Saber and Curve Finance?

Both focus on stablecoin swaps. Curve is on Ethereum and has more liquidity ($4B+). Saber is on Solana and is much faster and cheaper. Curve trades take 15+ seconds and cost $1-5. Saber trades take 0.4 seconds and cost $0.00025. If you’re trading under $10k, Curve is fine. For $50k+, Saber saves you thousands.

Can I earn yield on Saber?

Yes. You can provide liquidity by depositing two stablecoins (like USDC and USDT) into a pool. You earn 0.04% of every trade in that pool. There’s no impermanent loss because stablecoins don’t fluctuate in price. Some pools also offer SBR token rewards, but those are limited and subject to change.

Is Saber better than Jupiter for stablecoin swaps?

Jupiter is a DEX aggregator - it finds the best route across multiple exchanges, including Saber. But if you go directly to Saber, you’ll often get better rates and lower fees because Jupiter adds a small routing fee. For large stablecoin swaps, go straight to Saber. For small or multi-token trades, Jupiter is more convenient.

Dahlia Nurcahya

30 01 26 / 07:36 AMSaber’s insane for stablecoin swaps. I moved $200k from USDC to USDT last week and lost less than $80 in slippage. On Ethereum? I’d’ve lost over $1,500. No comparison. Solana’s the future for DeFi cash flow.

Akhil Mathew

31 01 26 / 06:29 AMWhy does everyone ignore the fact that Saber’s TVL is only $287M while Curve has $4B? It’s not even close. Speed and cost mean nothing if the liquidity dries up during a market crash. I’ve seen pools get wiped during volatility spikes - and Saber doesn’t handle that at all.

Aaron Poole

31 01 26 / 20:26 PMY’all are missing the real win here: capital efficiency. On Uniswap or Raydium, half your liquidity is just sitting there because the AMM has to account for price swings. Saber? 97% of every dollar is actively trading. That’s why even smaller pools can handle $100k swaps with near-zero slippage. It’s not magic - it’s math optimized for stablecoins.

Also, if you’re using wrapped assets like wUSDC, you’re trusting Wormhole. That’s a risk. But if you’re swapping native Solana USDC to USDT? Zero bridge risk. Just pure speed and dirt-cheap fees.

And yes, you need SOL for gas. Get over it. You need ETH on Ethereum too. This isn’t a bug - it’s how the chain works.

Ramona Langthaler

1 02 26 / 17:19 PMsaber is just solana fanboy shit. curve is real. sabers down 6 times last year and you still use it? lmao. crypto is about decentralization not speed. if your wallet goes down you lose everything. dumbass

Sunil Srivastva

3 02 26 / 07:34 AMBeen using Saber for months now for my yield farming rotations. The 0.04% fee going straight to LPs is a huge plus - no middlemen skimming. And the interface? So clean. No confusing token lists. Just pick your stable, pick your pair, hit swap. Done.

My only tip: always check if your stable is native or wrapped. If it’s wrapped, make sure the bridge is active. I had one swap fail because Wormhole was paused. Took 10 mins to figure out why.

Kevin Thomas

5 02 26 / 01:56 AMStop acting like Saber is some kind of holy grail. It’s a niche tool. If you’re not moving six figures in stablecoins, you’re wasting your time. Use Jupiter for small swaps - it’s faster to click and includes Saber anyway. And don’t forget: if Solana goes down, your entire DeFi stack goes with it. That’s not innovation, that’s fragility.

Also, the fact that 63% of users are pros? That’s a red flag. Retail shouldn’t be using this. It’s not designed for you.

Robert Mills

5 02 26 / 10:14 AMSABER = CHEAP + FAST = WIN 🚀💸 Just swapped 50k USDC → USDT in 0.3s. Fee: $0.00025. My bank transfer took 3 days. Crypto wins.

Joseph Pietrasik

6 02 26 / 10:46 AMsaber is just a glorified stablecoin vending machine. curve is decentralized. sabers just a solana shill. if you think this is the future you dont understand crypto. also why is there no governance? 18% voter turnout? lol

Gavin Francis

6 02 26 / 11:16 AMBiggest thing people don’t get: Saber’s not trying to beat Curve. It’s trying to beat Ethereum’s slowness. And it wins. Hard. You don’t need $4B in TVL if your trade takes 15 seconds and costs $3. Saber’s got 287M and does 1000x more swaps per second. That’s efficiency.

And yeah, Solana’s had outages - but so has Ethereum. Remember the 2021 NFT crash? Ethereum was down for 12 hours. Saber’s total downtime? 28 hours in two years. That’s not bad for a chain that’s still evolving.

Brandon Vaidyanathan

7 02 26 / 12:29 PMLook at the numbers. 0.04% slippage on $100k? That’s fine for a robot. But real traders? We need to move $5M. What happens then? Saber’s pools get drained. You think the 287M TVL can handle that? Nope. You’ll get 2% slippage and a front-run by a bot. This isn’t a tool - it’s a trap for the naive.

And don’t even get me started on wrapped assets. Wormhole got hacked for $320M. You’re trusting a bridge built by a team that can’t even keep their own code secure. That’s not DeFi - that’s gambling.

Steven Dilla

8 02 26 / 11:28 AMI used to think Saber was overhyped… until I lost $3k on Raydium swapping USDC to USDT. 0.2% slippage on a $1.5M trade? That’s $3k gone. Then I tried Saber. $600 slippage. Same trade. Same time. Same wallet.

It’s not even close. Saber’s the only reason I still use Solana. Raydium’s a mess. Jupiter’s a middleman. Saber? Pure, clean, fast stablecoin magic.

Also, SOL fees? Yeah, I get it. But you’re paying gas on every chain. It’s not special. It’s just how it works.

Jack Petty

10 02 26 / 09:20 AMsaber is a honeypot. they know you'll trade big stablecoins so they let you think it's safe. then when solana goes down or wormhole gets hacked again - your $2M vanishes. this isn't finance. it's a casino with a whitepaper. and the house always wins.

Brianne Hurley

10 02 26 / 21:37 PMLet’s be real - if you’re using Saber, you’re not a DeFi degenerate. You’re a corporate treasury manager with a Phantom wallet. This isn’t for retail. It’s for hedge funds moving cash between chains. And honestly? That’s kinda sad. Crypto was supposed to be for the people.

Now it’s just a faster, cheaper way for rich people to move dollars around without paying bank fees. Congrats. You built a Swiss bank on Solana.

christal Rodriguez

12 02 26 / 01:41 AMThe real question isn’t whether Saber is good. It’s whether we should be building systems that rely on one chain. If Solana fails, Saber fails. That’s not decentralization. That’s centralized risk with a fancy UI.