When you stake your crypto, you’re not just earning rewards-you’re betting your money on the network’s security. And if something goes wrong, the network doesn’t just pause your rewards. It slashes them. That means part-or all-of your staked tokens vanish overnight. No warning. No appeal. Just gone.

This isn’t theory. In April 2023, during Ethereum’s Shanghai upgrade, dozens of validators lost 100% of their 32 ETH deposits because of a software bug. Each one was worth over $50,000 at the time. That’s not a rare accident. It’s a design feature.

What Slashing Actually Means

Slashing is the blockchain’s way of punishing bad behavior. If a validator-a person or company running the software that confirms transactions-does something dangerous, the network automatically takes away part of their stake as a penalty. Think of it like a fine, but instead of paying cash, you lose your own crypto.

There are three main reasons slashing happens:

- Double-signing: When a validator signs two different blocks at the same height. This is like trying to confirm two conflicting transactions. It breaks consensus.

- Downtime: If your validator is offline for too long, it’s seen as not doing its job. Ethereum requires 99% uptime. Miss that, and you’re at risk.

- Invalid block proposals: Submitting blocks that don’t follow the rules. This could be a bug, a misconfiguration, or even a hack.

These aren’t minor mistakes. They’re network-threatening actions. And slashing exists to stop them.

How Much Can You Lose?

It depends on the network. Ethereum is the strictest. For minor offenses like brief downtime, you lose at least 1% of your stake. For double-signing? Up to 100%. And here’s the kicker: if multiple validators fail at once, penalties get worse. This is called correlated slashing. During the 2023 Ethereum incident, a single bug caused 27 validators to be slashed simultaneously-each losing their full 32 ETH.

Other networks handle it differently:

- Cosmos: Slashes 0.1% to 5% for downtime, 5% to 10% for double-signing. Less harsh, but more vulnerable.

- Solana: Slashes 100% for critical failures, but barely punishes downtime. Risky if your hardware fails.

- Polkadot: Slashes 1% to 100%, depending on severity. Flexible, but unpredictable.

- Avalanche: Slashes 0.5% to 3%. The middle ground.

That means if you stake on Ethereum, your potential loss is bigger. But if you stake on a smaller chain, you might earn more-but lose faster.

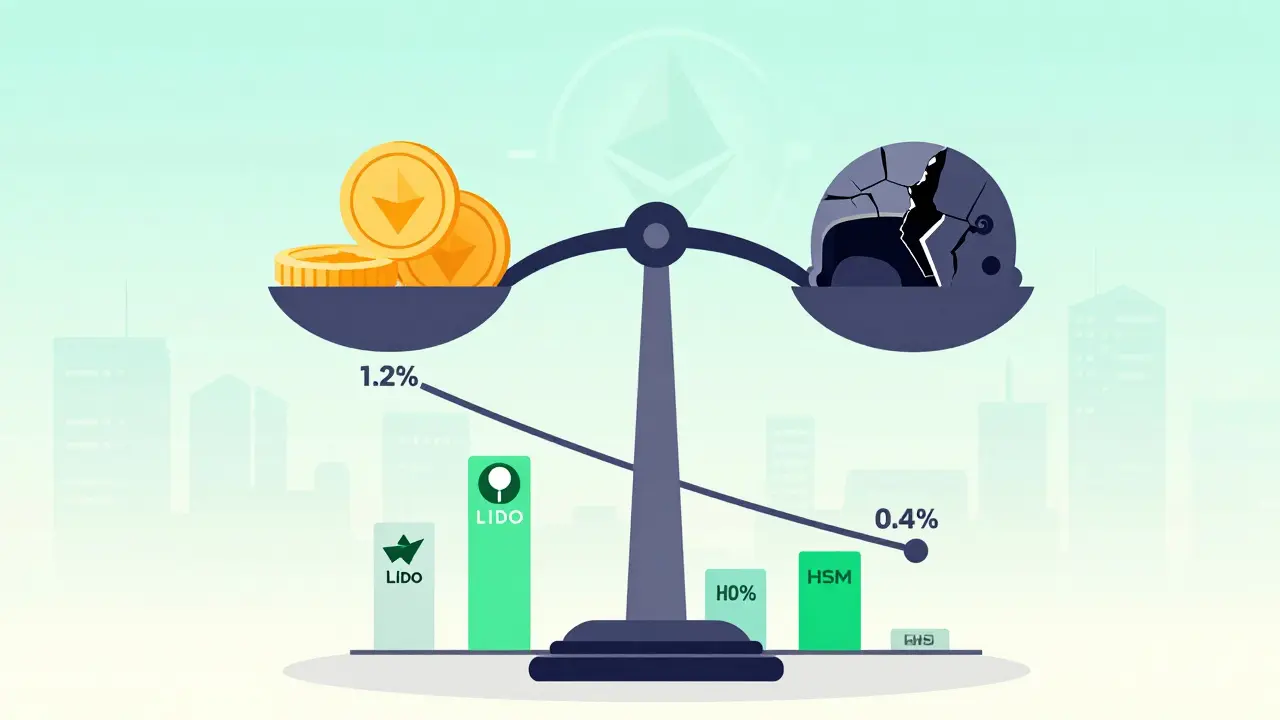

How Slashing Eats Into Your Returns

You might be earning 4% APY on your staked ETH. Sounds great. But if you get slashed 2% once a year? That’s half your profit gone. And it’s not just a one-time hit. Losing stake means less future rewards. Your staked balance shrinks. Your rewards shrink with it.

KPMG’s 2022 analysis found that poorly run validators lose 1.5% to 3.5% of their annual returns to slashing. Retail operators? They lose more. Institutional validators with proper setups lose under 0.1%. The difference? Infrastructure.

Here’s a real example: A user staked 10 ETH. They earned 0.4 ETH in rewards over a year. Then they got slashed 0.5 ETH. They didn’t just break even-they lost money. And it took them six months to recover the lost stake through new rewards.

Why Retail Stakers Get Slashed More

Most slashing incidents happen because of mistakes-not malice. And retail stakers make them.

Reddit threads from r/ethstaker show that 68% of users who got slashed lost their profits for over six months. The top causes? Simple stuff:

- 42%: Inadequate hardware. Running a validator on an old laptop or a $50 VPS.

- 31%: Software misconfiguration. Wrong client settings, outdated software, or not updating after a fork.

- 27%: No monitoring. Not checking if the node is online. No alerts. No backup.

Meanwhile, institutional stakers use hardware security modules (HSMs), redundant servers, and automated monitoring. These tools cut slashing risk by over 75%. But they cost $8,500 to $12,000 a year to run.

That’s the divide: You can either pay upfront to protect your stake-or pay later when it gets slashed.

The Hidden Cost of Slashing

Slashing doesn’t just hurt your wallet. It hurts the network.

When small validators get slashed, they quit. CoinDesk reported that 37% of retail operators stopped staking after one slashing event. That leaves only big players running nodes. And that’s the opposite of decentralization.

Networks like Ethereum rely on thousands of independent validators. If only 100 large companies are running them, the system becomes centralized. That’s why experts like Vitalik Buterin say the ideal slashing rate is 0.05% to 0.1% per year. Too high? Validators leave. Too low? Attackers take over.

The networks that get it right-keeping slashing between 0.5% and 1.5%-retain 92% of their validators. The ones that go above 2%? They lose over a third.

How to Avoid Getting Slashed

You can’t eliminate slashing. But you can reduce it to near-zero.

Here’s what actually works:

- Use a reputable staking provider. Lido, Coinbase, Kraken-they handle the infrastructure. Your risk drops by 90%. They’ve spent millions on HSMs, geographically distributed servers, and 24/7 monitoring.

- If you self-host, use HSMs. Hardware Security Modules store your signing keys offline. Stakin.com found HSMs reduce slashing risk by 83%.

- Monitor everything. Use Prometheus and Grafana. Set up SMS or email alerts for downtime. Check your node daily. No excuses.

- Run redundant systems. Two servers, two internet connections, two power sources. If one fails, the other keeps going.

- Update before upgrades. Ethereum’s Prague upgrade in Q2 2024 will lower minimum slashing from 1% to 0.5%. But if you’re running old software? You’ll get hit anyway.

Most people skip these steps because they think staking is passive. It’s not. It’s like running a small business. You need tools, monitoring, and discipline.

What’s Changing in 2026

The future of slashing is getting better.

Ethereum’s Prague upgrade will reduce the minimum penalty from 1% to 0.5%. That’s a big win. Delphi Digital predicts slashing rates will drop from 0.8-1.2% today to 0.3-0.5% by 2026. That could add 0.7-1.2% back to your annual returns.

Slashing insurance is also emerging. Companies like Nexus Mutual offer coverage-but they only cover 22% of common causes. Most policies exclude software bugs, misconfigurations, and downtime. So it’s not a magic fix.

The real solution? Better tools. More education. And less reliance on luck.

Bottom Line

Slashing isn’t a bug. It’s a feature. And it’s designed to make you care.

If you stake on a major network like Ethereum, you’re not just earning interest. You’re responsible for network security. And that comes with real risk.

Most people lose money not because crypto went down-but because they didn’t protect their validator. A $50 VPS won’t cut it. A home internet connection won’t cut it. And ignoring alerts won’t cut it.

The best way to avoid slashing? Let someone else handle it. Use a trusted staking provider. They’ve spent millions to make sure you don’t lose your stake. And if you’re going solo? Invest in the tools. Otherwise, you’re gambling.

Staking returns look great on paper. But slash one time, and you’ll remember why.

What causes slashing in staking?

Slashing happens when a validator commits a serious violation on a Proof-of-Stake blockchain. The three main causes are: double-signing (signing conflicting blocks), extended downtime (being offline too long), and proposing invalid blocks. These actions threaten network security, so the protocol penalizes them by destroying part of the validator’s staked tokens.

How much can you lose from slashing?

It varies by network. Ethereum can slash up to 100% of your stake for double-signing, with a minimum penalty of 0.5% after its 2024 upgrade. Cosmos and Polkadot typically slash 0.1% to 10%, while Solana imposes 100% penalties for critical failures. For most retail stakers, a single slashing event means losing 1-10% of their stake-but in correlated events, entire deposits can vanish.

Is slashing avoidable?

Yes, but not completely. Retail stakers who run nodes on weak hardware, ignore updates, or don’t monitor uptime are at high risk. Using hardware security modules (HSMs), redundant infrastructure, and professional monitoring tools can reduce slashing risk by over 75%. Most users who avoid slashing use institutional staking services like Coinbase or Lido, which handle all technical risks for you.

Do staking providers get slashed?

Yes, but rarely. Large providers like Coinbase, Kraken, and Lido have enterprise-grade setups: geographically distributed servers, HSMs, automated monitoring, and 24/7 teams. Their slashing rates are under 0.1% annually. Retail stakers, by contrast, often experience 1-2% annual slashing due to poor infrastructure. When a provider gets slashed, they usually absorb the loss and don’t pass it to users-unlike self-staking, where you lose your own funds.

Is slashing insurance worth it?

Not for most people. Services like Nexus Mutual offer slashing coverage, but they exclude 78% of common causes-like software bugs, misconfigurations, or downtime. The premiums (0.5% to 2.5% of staked value) often cost more than the risk you’re insuring. For retail stakers, it’s better to invest in proper infrastructure than pay for insurance that won’t cover what actually breaks.

Will slashing get worse or better in the future?

It’s getting better. Ethereum’s Prague upgrade in 2024 will reduce minimum slashing from 1% to 0.5%. Improved validator tools, better monitoring software, and protocol refinements are lowering slashing rates across networks. Delphi Digital predicts slashing will drop from 0.8-1.2% annually today to 0.3-0.5% by 2026. That means stakers will keep more of their rewards.

Elijah Young

15 02 26 / 04:12 AMSlashing is brutal, but honestly? It’s what keeps the network honest. I’ve seen people treat staking like a savings account, and it’s not. It’s infrastructure. If you’re running a validator on a Raspberry Pi and wondering why you got slashed, you’re not a victim-you’re a liability.

Beth Trittschuh

16 02 26 / 22:26 PMI think about slashing like a moral contract. You’re not just staking crypto-you’re staking your integrity. When you run a node, you’re saying, ‘I believe in this system enough to risk my capital for its survival.’ That’s beautiful. And terrifying. 🌌

Benjamin Andrew

17 02 26 / 07:38 AMLet’s cut through the noise. The real issue isn’t slashing-it’s the delusion that retail staking is accessible. You think you’re ‘participating in decentralization’? No. You’re a single point of failure with a $30 VPS. The system doesn’t care about your feelings. It cares about uptime. And if you can’t afford to run it right? Don’t run it at all.

Joe Osowski

19 02 26 / 05:20 AMWhy are we even pretending this isn’t a scam? You stake ETH, you think you’re earning passive income, then BAM-some algorithm nukes your life savings because your router rebooted. This isn’t finance. It’s Russian roulette with blockchain branding. And the ‘experts’? They’re just selling you HSMs so they can get rich off your panic.

Jeremy Lim

19 02 26 / 14:23 PM...I just... I ran my validator for 8 months... no alerts... no HSM... just a cheap VPS... and then... one day... it was gone... 32 ETH... poof... I didn’t even have time to cry... 😔

John Doyle

19 02 26 / 19:30 PMDon’t let fear stop you. Slashing is scary, yeah-but so is missing out on the future. If you’re new, start with Lido or Coinbase. Learn how it works. Watch your node. Read the docs. It’s not magic. It’s just work. And work you can do. You got this.

Grace Mugambi

21 02 26 / 06:21 AMSlashing forces us to ask: What are we really building? A financial product? Or a decentralized society? If we design systems that punish small actors for human error, are we creating inclusion-or exclusion? Maybe the real question isn’t how to avoid slashing… but whether we should be building systems that make it so devastating in the first place.

Crystal McCoun

22 02 26 / 22:17 PMIf you’re self-staking, here’s your checklist: 1. HSM? Check. 2. Dual internet lines? Check. 3. Prometheus + Grafana? Check. 4. SMS alerts? Check. 5. Backup power? Check. 6. Updated client? Check. 7. Tested failover? Check. 8. Monthly review? Check. If you missed any of these-you’re not ‘staking.’ You’re gambling.

Donna Patters

24 02 26 / 14:01 PMIt’s not a bug. It’s a feature. And if you’re too lazy to secure your node? You don’t deserve to earn rewards. You’re a parasite on the ecosystem. The network doesn’t owe you a safety net. You owe it discipline.

Michelle Cochran

25 02 26 / 01:14 AMWho are we really protecting here? The ‘retail staker’? Or the institutional oligarchs who already own 70% of the validators? Slashing isn’t about security-it’s about consolidation. The system is designed to push out the little guys. And the ‘solutions’? They cost $10K/year. That’s not accessibility. That’s exclusion dressed up as wisdom.

monique mannino

26 02 26 / 04:52 AMJust wanted to say-I started with Lido last year. Didn’t know what HSM meant. Still don’t. But I sleep well. 🌙✨ No stress. No alerts. Just ETH growing. Sometimes the best tech is the one you don’t have to touch.

Peggi shabaaz

26 02 26 / 19:37 PMslashing is just part of the game. like traffic tickets. you drive too fast? you get fined. you run a bad node? you get slashed. no drama. no tears. just keep going. 🌱