Yield farming isn’t just a buzzword anymore-it’s a core way people earn passive income in DeFi. If you’ve ever wondered how some users make money just by holding crypto without selling, this is how. You lock up your tokens in a smart contract, help other people trade or borrow, and get paid in return. Simple? On the surface, yes. But the real game is in knowing which platforms actually deliver, and which ones are just flashy promises with hidden risks.

Curve Finance: The Safe Harbor for Stablecoin Farmers

If you want low stress and steady returns, Curve Finance is still the go-to. Launched in 2020, it’s one of the oldest and most audited protocols in DeFi. It doesn’t chase wild APYs. Instead, it focuses on stablecoins-USDC, DAI, USDT, and others-where price swings are minimal. That means less risk of impermanent loss, which is a fancy term for losing money because the value of your two tokens drifts apart.

In 2025, Curve’s APYs hover between 5% and 15%. That might sound boring next to 70% offers elsewhere. But here’s the catch: those returns are sustainable. They come from trading fees, not token inflation. When people swap USDC for DAI on Curve, a tiny fee is charged-and that fee gets distributed to liquidity providers like you.

Curve doesn’t auto-compound. So if you want to grow your rewards faster, you’ll need to pair it with Convex or Yearn. Locking your CRV tokens as veCRV gives you extra rewards and voting power in the protocol. It’s not complicated, but it’s not set-and-forget either. If you’re the type who checks your portfolio once a week and wants to sleep well at night, Curve is your best bet.

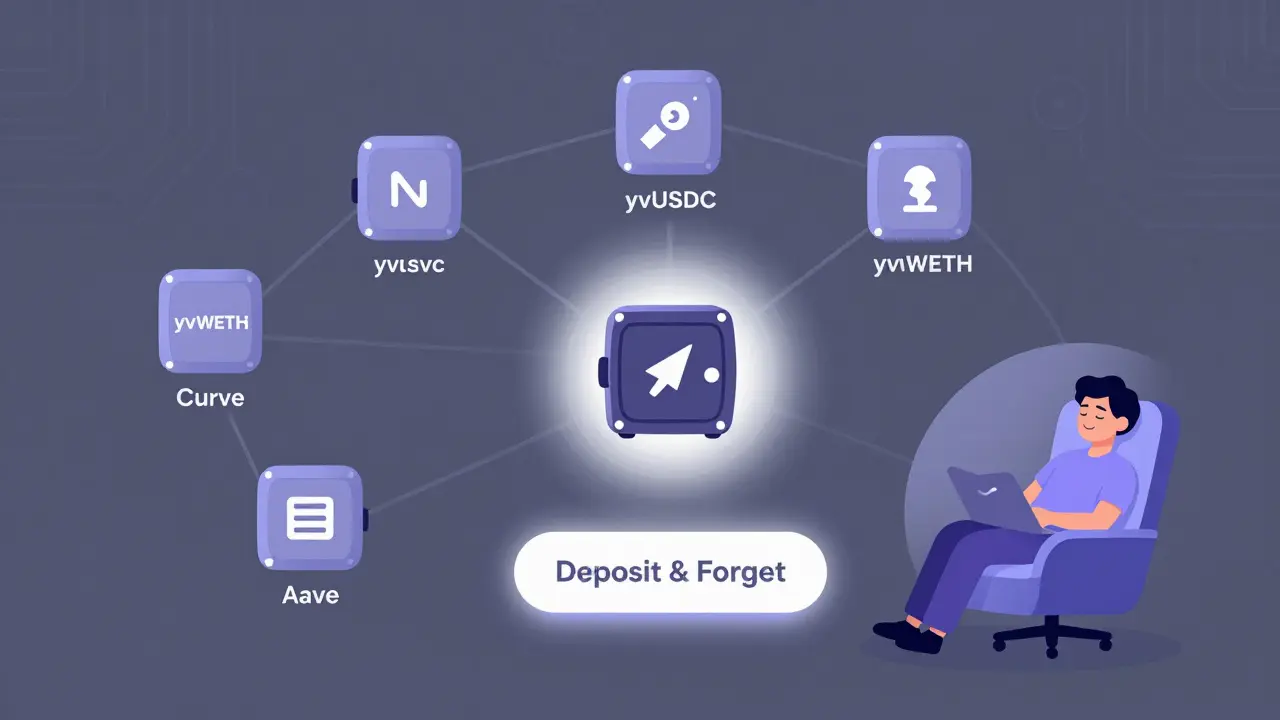

Yearn Finance: The Hands-Off Yield Aggregator

Yearn Finance is like having a personal DeFi trader working 24/7 for you. Created by Andre Cronje, it doesn’t run its own liquidity pools. Instead, it moves your money between Curve, Aave, Compound, and others-whichever is paying the highest yield at any given moment.

Its vaults handle everything: depositing, swapping, compounding, withdrawing. You pick a vault (like yvUSDC or yvWETH), deposit your tokens, and forget about it. In 2025, APYs range from 4% to 20%, depending on the asset and market conditions. The platform takes a small fee-usually 10% of earnings-but the convenience is worth it for most beginners.

Yearn’s interface is clean, transparent, and easy to use. No need to understand AMMs, staking, or cross-chain bridges. Just connect your wallet, pick a vault, and click deposit. It’s the closest thing to a “set and forget” yield farming experience. The downside? When gas fees spike on Ethereum, your small deposits might earn less than expected. But for users who don’t want to manage multiple wallets or track dozens of protocols, Yearn still leads the pack.

GMX: Earn From Trading Fees, Not Just Tokens

GMX flips the script. Instead of lending your tokens to others, you become part of the market itself. GMX lets you provide liquidity to its GLP pool-a basket of assets like ETH, BTC, USDC, and AVAX. In return, you earn a share of the fees generated by traders using GMX’s decentralized perpetual exchange.

Think of it like owning a tiny piece of a crypto futures trading platform. When traders open long or short positions, GMX charges fees. If they lose, those losses go to liquidity providers like you. That’s why GMX’s APYs (10-20% in 2025) feel more grounded than others. They’re not inflated by token emissions. They’re backed by real trading volume.

GMX pays rewards in ETH and esGMX (a vested version of its token). GLP auto-compounds, so your rewards grow over time. But there’s a catch: if the market swings wildly and traders win big, you could lose money on your GLP position. It’s not a guarantee of profit-it’s a bet on trading activity. That makes GMX better suited for experienced users who understand derivatives and volatility. If you’re comfortable with the idea that your returns depend on how well (or poorly) other traders do, GMX is one of the most innovative options out there.

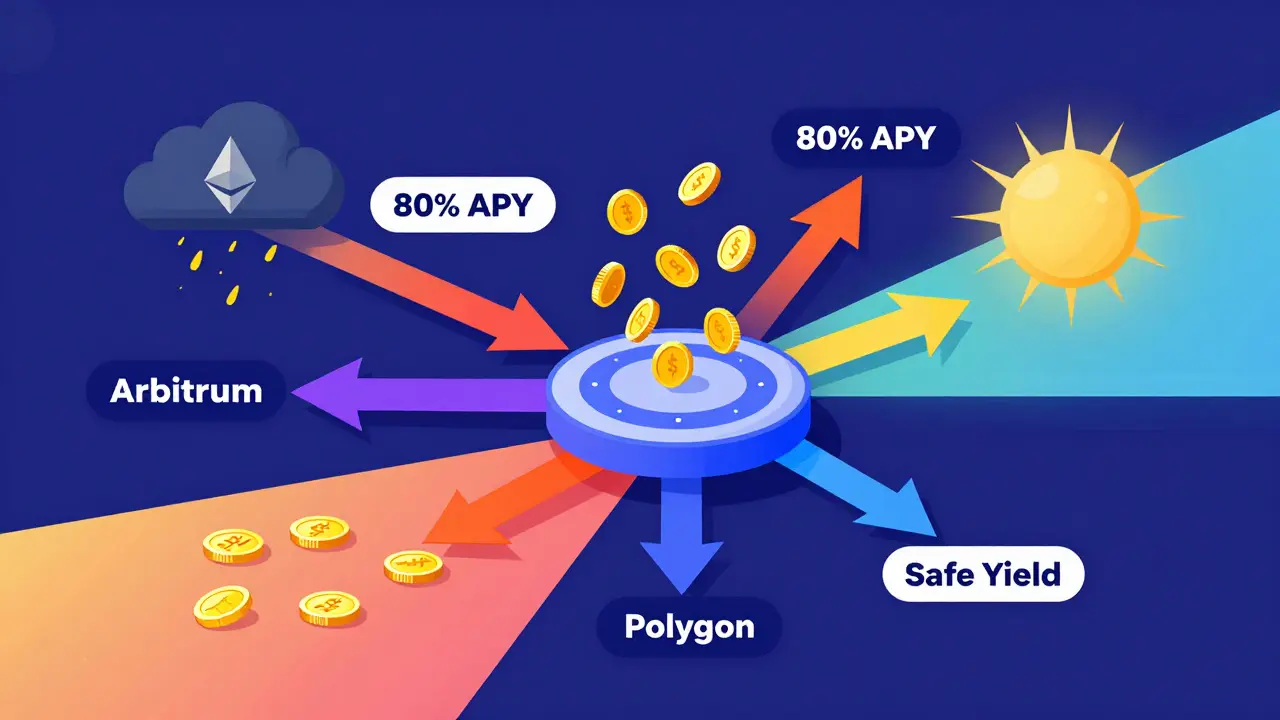

Beefy Finance: The Cross-Chain Powerhouse

Beefy Finance is the Swiss Army knife of yield farming. It supports over 30 blockchains-from Ethereum and BNB Chain to Polygon, Arbitrum, and even TON. Instead of being stuck on one network, Beefy lets you farm across them all with a single interface.

Its vaults auto-compound rewards and shift funds between protocols to chase the best APYs. In 2025, returns range from 5% to 80%. Yes, 80%. But here’s the reality: those ultra-high yields come with high risk. Many are tied to new or unproven tokens, or rely on complex multi-layered strategies that could break if one underlying protocol fails.

Beefy’s strength is accessibility. You don’t need to manage 10 different wallets or bridge assets manually. Just pick a vault, deposit, and let Beefy do the heavy lifting. But that convenience comes with complexity. You’re trusting Beefy’s smart contracts, the protocols it connects to, and the bridges that move your funds between chains. A bug in any one of those could cost you. Users report great returns-but also stress over understanding what’s actually backing their yields. If you’re willing to do the homework and accept higher risk, Beefy unlocks opportunities no single-chain platform can match.

What’s Changed in 2025? Key Trends You Can’t Ignore

The yield farming game has evolved. In 2020, you could earn 100% APY just by staking ETH on a new protocol. Today, the market has matured. Inflationary rewards have dropped. Real utility-trading fees, real-world asset tokenization, and cross-chain efficiency-is what matters now.

Cross-chain farming is no longer optional. Bridges like LayerZero and Wormhole let you move assets between chains quickly and cheaply. That means you can farm on BNB Chain for high APYs one day, then switch to Arbitrum for lower fees the next. Platforms like Beefy automate this, but even manual farmers now treat chains as interchangeable.

Auto-compounding is standard. If a platform doesn’t compound your rewards automatically, you’re leaving money on the table. Manual compounding eats into profits through gas fees and time.

Security is better, but not perfect. Major protocols now have real-time monitoring, insurance funds, and multi-sig emergency stops. But scams still happen-especially with new tokens or obscure chains. Always check if a protocol has been audited by reputable firms like CertiK or Trail of Bits.

Real-world assets (RWA) are entering DeFi. Platforms like Maple Finance and Centrifuge let you earn yield from loans backed by real estate, invoices, and commodities. These aren’t crypto-native, but they’re starting to show up in yield farming portfolios. It’s still early, but this could be the next big wave.

How to Choose the Right Platform for You

There’s no one-size-fits-all answer. Your choice depends on three things:

- Risk tolerance - Are you okay with losing money if a token crashes? Then go for high-APY vaults. Prefer steady, slow growth? Stick to Curve or Yearn.

- Time commitment - Do you want to check your portfolio daily? Then Beefy’s complexity might frustrate you. Prefer hands-off? Yearn or GMX are better.

- Technical comfort - Can you explain what impermanent loss is? Do you know how to use a bridge? If not, start with Yearn. If you’ve been in DeFi for a year or more, GMX and Beefy offer more upside.

Most successful farmers don’t pick just one. They diversify. Maybe 50% in Curve for safety, 30% in Yearn for automation, and 20% in Beefy for high-risk upside. That way, even if one strategy underperforms, the rest keep you covered.

Common Mistakes That Cost Farmers Money

Even smart people lose money in yield farming. Here are the top three mistakes:

- Ignoring gas fees - If you’re farming $500 worth of tokens and gas costs $20 per compounding cycle, you’re eating up 4% of your return. Always factor fees into your math.

- Chasing the highest APY - A 70% APY might look amazing, but if the token is new and untested, you’re risking your principal. Look at the token’s market cap, liquidity, and audit history.

- Not tracking your positions - If you’re farming on five different platforms, you need a dashboard. Use DeBank or Zapper to see all your yields, risks, and rewards in one place. Without it, you’re flying blind.

There’s no magic formula. But if you focus on sustainability over hype, and safety over speed, you’ll outlast the gamblers.

Is yield farming still profitable in 2025?

Yes, but it’s not the wild west it was in 2021. APYs have normalized. You won’t find 200% returns anymore, but reliable 5-20% yields are still common-especially on stablecoins, cross-chain platforms, and protocols with real trading volume like GMX. Profitability now depends on strategy, not luck.

Which platform has the lowest risk for beginners?

Yearn Finance is the safest starting point. Its vaults are automated, audited, and designed for non-technical users. Curve Finance is also low-risk if you’re comfortable with manual compounding. Both focus on stablecoins, which are less volatile than other crypto assets.

Can you lose money in yield farming?

Absolutely. You can lose money from impermanent loss (when token prices shift), smart contract exploits, token devaluation, or high gas fees. Even GMX can result in losses if traders on the platform win big. Yield farming is not risk-free-it’s a calculated investment.

What’s the difference between APY and APR in yield farming?

APR (Annual Percentage Rate) is the simple interest you earn in a year. APY (Annual Percentage Yield) includes compounding-the effect of earning interest on your interest. Most yield farming platforms advertise APY because it’s higher and more attractive. Always check whether the APY is based on daily, hourly, or weekly compounding-it affects your real returns.

Do I need to use a wallet like MetaMask?

Yes. You’ll need a Web3 wallet like MetaMask, Coinbase Wallet, or Phantom (for Solana-based chains) to connect to any yield farming platform. These wallets let you sign transactions and interact with smart contracts. Never use an exchange wallet (like Binance or Coinbase) for farming-your funds won’t be under your control.

Are yield farming rewards taxed?

In most countries, yes. Rewards earned from yield farming are typically treated as income when you receive them, and capital gains when you sell. Tax rules vary by jurisdiction, but keeping detailed records of every deposit, withdrawal, and reward is essential. Tools like Koinly or TokenTax can help track taxable events.

Don Grissett

10 01 26 / 11:36 AMYield farming in 2025? More like yield *faking*. Everyone’s chasing 80% APYs like it’s 2021. The only thing growing faster than returns is the number of rug pulls. I’ve seen three projects vanish this month alone. Stick to stablecoins or don’t bother.

Mollie Williams

12 01 26 / 08:57 AMThere’s something quietly poetic about Curve Finance. It doesn’t scream. It doesn’t promise moonshots. It just… exists. Like a quiet river that’s been flowing for centuries. You don’t get rich fast, but you don’t get washed away either. Maybe the real win isn’t the APY-it’s the peace of mind that comes from knowing your money isn’t betting on someone else’s gamble.

kris serafin

13 01 26 / 06:46 AMIf you're new and reading this, start with Yearn. No cap. Just deposit yvUSDC and walk away. I've had mine running for 8 months and never once checked it. The 12% APY isn't flashy, but it's *real*. And auto-compounding? Game changer. 🚀

Surendra Chopde

13 01 26 / 13:21 PMI tried GMX last month. Lost 18% in two weeks because traders kept winning. I thought I was earning from their losses… turns out I was just their ATM. Don’t let the ‘real trading fees’ marketing fool you. If you don’t understand perpetuals, don’t touch it.

Ritu Singh

13 01 26 / 17:12 PMThey say Curve is safe… but who controls the veCRV voting? Big wallets. Big funds. Big banks pretending to be decentralized. The whole system is rigged. You think you’re farming? You’re just feeding the machine that feeds the elite. Wake up.

Meenakshi Singh

14 01 26 / 23:02 PMBeefy’s 80% APY on some TON token? LOL. I checked the contract. It’s just a rebase with a fancy UI. The token’s market cap is $400k. That’s not yield farming. That’s a Ponzi with a blockchain tattoo. 🤡

Becky Chenier

16 01 26 / 04:08 AMI appreciate how detailed this post is. It’s rare to see someone explain impermanent loss without sounding like a textbook. I used to think DeFi was just gambling-now I see it’s more like gardening. Some plants grow fast and die. Others take years but last decades.

Tre Smith

16 01 26 / 15:10 PMYou mention GMX’s APY is ‘grounded’ because it’s backed by trading volume. That’s a laugh. Trading volume is manipulated. Bots. Wash trading. Fake liquidity. The entire DeFi ecosystem is a house of mirrors. You’re not earning from real activity-you’re earning from illusion. And you call that ‘sustainable’?

Frank Heili

17 01 26 / 01:13 AMDon’t forget about RWA. Maple Finance’s yield on commercial real estate loans is averaging 9.5% with AAA-rated collateral. No crypto volatility. No impermanent loss. Just cash flow from actual buildings. This is the future. Crypto yield farming is just the training wheels.

jim carry

17 01 26 / 19:50 PMI’ve been farming for 5 years. I’ve lost more than I’ve made. I’ve cried over my laptop. I’ve screamed at my phone. I’ve deleted my wallet three times. But I keep coming back because I’m addicted to the thrill. You think this is finance? It’s a casino with a whitepaper.

Emily Hipps

19 01 26 / 10:39 AMTo anyone starting out: you don’t need to do everything. You don’t need to be on 10 chains. You don’t need to understand every protocol. Just pick one safe option. Learn it. Master it. Then grow. I started with Yearn. Now I’m at 12% APY with zero stress. You can too. You’ve got this 💪

Krista Hoefle

20 01 26 / 22:11 PMCurve? Yearn? Lame. Real farmers are on zkSync with some new token no one’s heard of. If you’re not chasing 50%+ APYs, you’re already behind. Stop listening to old men in forums. The future is fast, risky, and unregulated.

greg greg

21 01 26 / 20:01 PMI think what’s missing from this entire discussion is the psychological toll of yield farming. The constant checking. The anxiety over gas prices. The sleepless nights wondering if the contract you deposited into is going to implode. The way you start talking to your wallet like it’s a living thing. I used to think DeFi was about money. Now I know it’s about identity. You’re not just farming yield-you’re farming a new version of yourself. And sometimes, that version is exhausted, paranoid, and deeply lonely.

Sarbjit Nahl

22 01 26 / 21:52 PMThe idea that Curve is ‘safe’ is a myth. All DeFi is permissionless. All smart contracts are vulnerable. All liquidity pools are susceptible to flash loan attacks. You’re not avoiding risk-you’re just ignoring it. The only true safety is not participating.

Dennis Mbuthia

23 01 26 / 22:36 PMAmerica still leads in DeFi innovation. Europe? Too slow. China? Too controlled. India? Too chaotic. Only the US has the right mix of tech, capital, and legal gray space to make this work. If you’re not farming on Ethereum or Arbitrum, you’re not serious. This isn’t global-it’s American.

Veronica Mead

24 01 26 / 12:31 PMIt is profoundly troubling that so many individuals, in their pursuit of financial gain, willingly surrender their capital to unregulated, unaudited, and often anonymously operated smart contracts. The moral hazard inherent in this system is not merely financial-it is existential. To entrust one’s livelihood to code written by strangers, with no recourse, no liability, and no accountability, is not innovation. It is abdication.

Valencia Adell

25 01 26 / 09:44 AMYou mentioned RWA. Let me tell you about Maple Finance. They had a $20M loan default last month. The ‘AAA collateral’? A warehouse in Ohio that’s been empty for 3 years. They paid out 30% of the loss. The rest? Gone. ‘Real-world assets’ are just crypto with a suit on. Don’t be fooled.