GMO Coin Fee Calculator

Trading Calculator

Calculate your exact trading costs using GMO Coin's unique fee structure

How GMO Coin Fees Work

Takers (market orders): Pay 0.05% per trade

Results

Enter your trading details to see fees

Industry Comparison:

Standard exchange taker fees: ~0.10% (vs. GMO's 0.05%)

Professional exchange maker fees: Rarely < -0.01% for retail users

When you’re looking for a crypto exchange, you don’t just want to trade Bitcoin or Ethereum-you want to feel safe, know the fees won’t eat your profits, and not waste hours trying to figure out how to deposit money. That’s where GMO Coin comes in. But here’s the catch: it’s not built for everyone. If you live in Japan, it might be one of the best options you have. If you’re anywhere else, you’re probably better off looking elsewhere.

Who Runs GMO Coin? The Backing Matters

GMO Coin isn’t some anonymous startup with a slick website and no track record. It’s owned by GMO Internet Group, a publicly traded company on the Tokyo Stock Exchange (ticker: 9449). That’s not just a nice detail-it means there’s real corporate oversight, financial reporting, and accountability. Unlike many crypto-only platforms that vanish when markets crash, GMO has been around since 2016 and is backed by a 25-year-old Japanese tech and financial services giant. But being part of a big company doesn’t mean it’s flawless. In March 2025, Japan’s Financial Services Agency (FSA) issued a business improvement order to GMO Coin. That’s a formal warning that something in their operations isn’t meeting regulatory standards. The exact issues weren’t made public, but it’s a red flag for anyone expecting perfect compliance.What You Can Trade-And What You Can’t

As of 2025, GMO Coin supports only five cryptocurrencies: Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Bitcoin Cash (BCH), and Ripple (XRP). That’s it. No Solana, no Dogecoin, no Polkadot, no meme coins. If you’re the kind of trader who likes to chase altcoins, you’ll hit a wall fast. The platform offers just five trading pairs-mostly BTC/JPY, ETH/JPY, and similar fiat pairs. No BTC/USDT, no ETH/BTC. That’s because GMO Coin is designed for Japanese retail investors who want to buy crypto with yen, not trade between cryptos. It’s a simple, focused model. But if you want flexibility, you’re looking at a platform that’s stuck in 2018.Fees: The One Thing They Do Better Than Everyone Else

Here’s where GMO Coin stands out-big time. Most exchanges charge you to trade. GMO Coin pays you. Their maker-taker fee structure works like this:- Makers (people who add liquidity by placing limit orders): get paid -0.01% per trade. That means for every $1,000 you trade as a maker, you earn $0.10.

- Takers (people who remove liquidity by buying or selling at market price): pay 0.05%.

How to Deposit Money-And Why It’s a Problem

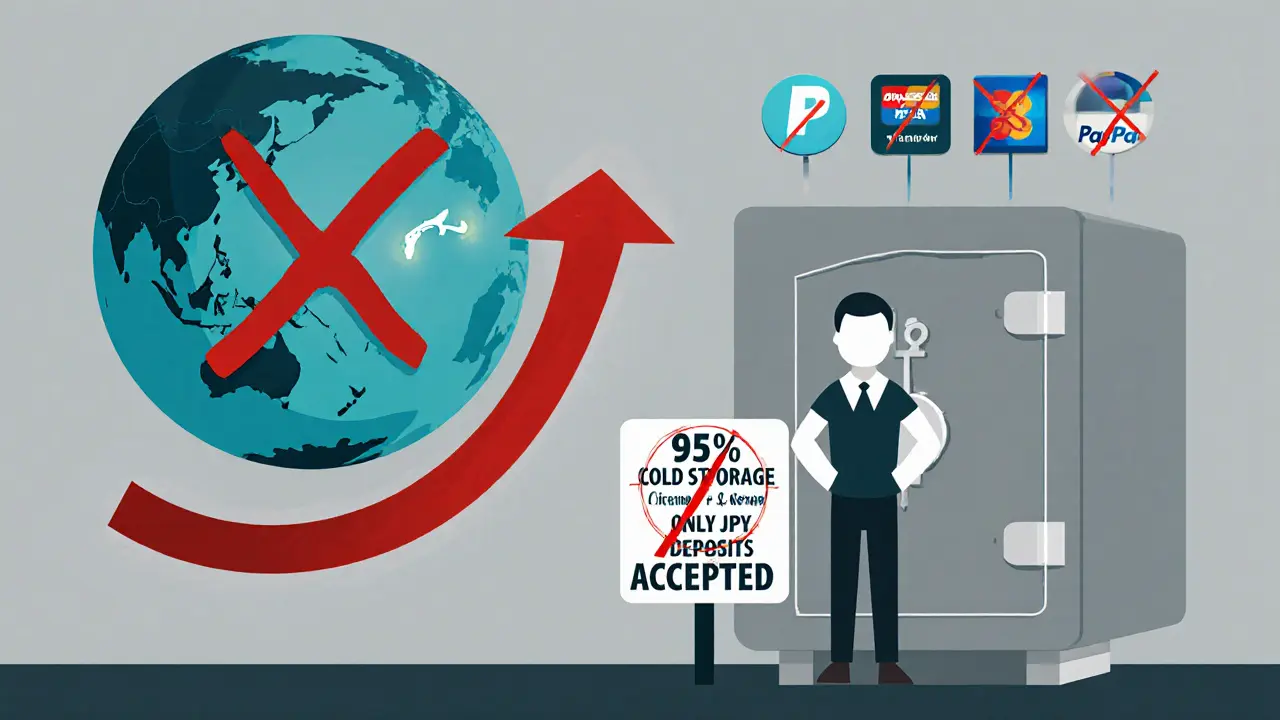

GMO Coin only accepts bank wire transfers for fiat deposits. No credit cards. No PayPal. No Apple Pay. No instant bank links like SEPA or Faster Payments. That’s a dealbreaker for most international users. In 2025, 78% of top exchanges let you buy crypto with a card in under 5 minutes. GMO Coin? You have to initiate a bank transfer from your account, wait 1-3 business days for it to clear, and then wait another 1-2 days for your account to be credited. If you’re trying to jump on a price surge, you’ll miss it. And if you’re not in Japan? Forget it. You need a Japanese bank account and proof of residency to open an account. The KYC process takes 5-7 business days-twice as long as most global exchanges. And if you don’t speak Japanese, good luck navigating the forms.Security: Solid, But Not Transparent

GMO Coin claims to store 95% of customer funds in cold storage. That’s standard for reputable exchanges. Two-factor authentication is required. No known major hacks in its history. That’s reassuring. But here’s the problem: they don’t publish proof. No third-party audits. No public proof-of-reserves reports. No transparency around encryption standards or penetration testing. For a company that’s supposed to be regulated, that’s a big gap. Competitors like Kraken and Bitstamp release monthly audit reports. GMO doesn’t. That makes it harder to trust, even if the track record is clean.

App and Interface: Built for Japanese Users

The web platform and mobile apps (iOS and Android) are clean and functional. But almost everything is in Japanese. Only about 35% of help articles, support pages, and tooltips are translated into English. If you’re not fluent, you’ll be guessing what buttons do. Customer support is another pain point. You can email them (48-hour average response), call (Japanese only), or use live chat (8 AM-6 PM Japan time). No 24/7 support. No multilingual agents. That’s not just inconvenient-it’s risky. If your funds get stuck during a market crash, you won’t be able to reach anyone outside business hours. Trustpilot reviews from international users average 2.3 out of 5. Common complaints: “I couldn’t figure out how to deposit,” “Support didn’t reply for a week,” “I gave up after three days.”Who Is GMO Coin Actually For?

Let’s be clear: GMO Coin isn’t for crypto enthusiasts who want to trade hundreds of coins. It’s not for people who need instant deposits. It’s not for non-Japanese speakers. It’s for one group: Japanese residents who want a safe, regulated way to buy and hold Bitcoin and Ethereum with yen. If you live in Japan, have a local bank account, and want low fees with strong institutional backing, GMO Coin is one of the top choices. It’s ranked 4th in Japan’s $28.7 billion crypto market, behind BitFlyer, Coincheck, and Liquid. It’s not the biggest, but it’s one of the most stable. For everyone else? Look at Kraken, Binance (where available), or Coinbase. They offer more coins, faster deposits, better support, and global accessibility. GMO Coin is a regional player with global ambitions-but right now, it’s still very much a Japan-only product.The Future: Can GMO Coin Go Global?

GMO Coin has hinted at expansion. Their 2025-2027 roadmap, leaked to Nikkei Asia, says they plan to add 10 more trading pairs by the end of 2025 and seek licenses in Southeast Asia. They’ve also started offering staking for three proof-of-stake coins and a lending program where users earn rental fees on idle crypto. But here’s the reality: without solving the language barrier, the deposit issue, and the regulatory blind spots outside Japan, expansion is unlikely. Their FSA warning in March 2025 shows they’re under pressure to clean up their act at home. If they can’t fix that, they won’t get far overseas. For now, GMO Coin is a niche exchange with a brilliant fee structure and a serious localization problem. It’s a great tool if you’re in the right place. If you’re not? It’s a dead end.Is GMO Coin safe to use?

GMO Coin has strong security practices, including cold storage for 95% of assets and two-factor authentication. It’s owned by a publicly traded Japanese company with a clean history of no major breaches. But it doesn’t publish proof-of-reserves or third-party audit reports, which reduces transparency. For Japanese users under FSA oversight, it’s considered relatively safe. For international users, the lack of clear regulatory status outside Japan raises red flags.

Can I use GMO Coin if I live outside Japan?

Technically, no. To open an account, you need proof of Japanese residency and a Japanese bank account. The platform doesn’t accept international IDs or foreign bank transfers. Even if you manage to sign up, customer support is mostly in Japanese, and the interface isn’t designed for non-Japanese users. Most international traders find it too difficult to use and switch to exchanges like Kraken or Binance.

Does GMO Coin charge withdrawal fees?

No, GMO Coin does not charge any withdrawal fees beyond the standard blockchain network fees. If you’re sending Bitcoin, you pay the miner fee. If you’re sending Ethereum, you pay the gas fee. GMO Coin adds nothing on top. This is rare among exchanges and one of their biggest advantages.

What are the trading fees on GMO Coin?

GMO Coin uses a maker-taker model: makers (those placing limit orders) earn -0.01% per trade (they get paid), while takers (those executing market orders) pay 0.05%. This is significantly lower than the industry average of 0.10% for takers and far better than most platforms that charge makers 0.02% or more. It’s one of the most user-friendly fee structures in the crypto space.

Can I trade altcoins on GMO Coin?

No. As of 2025, GMO Coin only supports five cryptocurrencies: Bitcoin, Ethereum, Litecoin, Bitcoin Cash, and Ripple. There are no altcoins like Solana, Cardano, or Polkadot. The platform is designed for basic BTC/ETH trading with Japanese yen, not for active altcoin traders.

Does GMO Coin offer staking or lending?

Yes. As of June 2025, GMO Coin offers staking for three proof-of-stake cryptocurrencies and a lending program where users can earn rental fees by lending their coins. Exact APY rates aren’t publicly listed, but the features are expanding as part of their effort to retain users in Japan’s competitive crypto market.

How long does it take to verify my account on GMO Coin?

Account verification takes 5-7 business days on average, which is longer than the industry standard of 2-3 days. This is because the platform requires strict FSA-compliant documentation, including proof of Japanese residency. International users often get stuck at this stage because their documents aren’t accepted.

Is GMO Coin regulated outside Japan?

No. GMO Coin is only regulated by Japan’s Financial Services Agency (FSA). It has no licenses in the U.S., EU, UK, or other major markets. This means users outside Japan have no legal protection if something goes wrong. Competitors like Kraken and Bitstamp are regulated in multiple jurisdictions, making them safer for global users.

Meagan Wristen

9 11 25 / 14:55 PMOkay, but let’s be real - GMO Coin’s fee structure is the only thing keeping it alive in 2025. I’ve used Binance, Kraken, even Bitstamp, and nothing gives you money just for placing a limit order. It’s like the exchange is saying, ‘Thanks for helping us keep the order book healthy.’ That’s not just smart - it’s revolutionary for retail traders. Even if you can only trade five coins, that rebate adds up over time.

And no withdrawal fees? That’s not a feature - it’s a middle finger to every other exchange that treats users like ATMs.

Becca Robins

10 11 25 / 12:35 PMso like… if i’m not in japan, this is just a fancy brick wall with a logo? 🤡

Vivian Efthimiopoulou

12 11 25 / 10:00 AMThere is a deeper philosophical tension here: GMO Coin represents the paradox of institutional trust in an anarchic space. A publicly traded Japanese conglomerate, bound by regulatory scrutiny and corporate accountability, operating a crypto exchange - a sector built on decentralization and distrust of intermediaries.

It’s as if a monastery decided to run a black market. The discipline is admirable, the structure impeccable - but the soul of the thing? It’s compromised. The very nature of crypto resists the rigidity of corporate oversight. And yet, for the Japanese retail investor seeking safety, this is the only bridge between chaos and order.

But for the rest of us? We are not invited to the table. We are told to go elsewhere - to platforms that are faster, more flexible, but far less accountable. Is safety a luxury only the insular can afford? Or is it the only ethical option in a world where anonymity breeds exploitation?

Perhaps GMO Coin is not a failure of vision - but a quiet, stubborn act of integrity in a field that has forgotten what integrity means.

Angie McRoberts

13 11 25 / 07:09 AMYep. You're basically paying to be a Japanese citizen. 😅

Also, no support outside business hours? In 2025? That's not 'localized' - that's just negligent. If your funds are frozen during a flash crash and you can't reach anyone… that’s not a risk. That’s a trap.

Liam Workman

13 11 25 / 10:19 AMI get why people hate this place - but I also get why it exists.

Crypto is full of cowboys. Greedy devs, anonymous teams, rug pulls disguised as ‘decentralized finance.’ GMO Coin? It’s the guy in a suit who shows up to the rave with a first aid kit and a water cooler. Not exciting. Not flashy. But when things go sideways - you’re glad he’s there.

Yeah, it’s clunky. Yeah, it’s Japan-only. But if you live there? It’s the most responsible option on the table. And honestly? Maybe the world needs more of these boring, regulated, slow-moving giants. Not every platform has to be a rocket ship. Sometimes you just need a reliable bus.

Also - maker rebates? That’s not a gimmick. That’s a gift to the market. Someone’s finally thinking about liquidity, not just commissions.

Diana Smarandache

15 11 25 / 02:14 AMLet me be crystal clear: GMO Coin is not a crypto exchange. It is a Japanese banking service with a crypto interface. Anyone who expects global functionality is delusional. The FSA warning wasn’t a scandal - it was a reminder that this platform operates under strict national oversight. If you don’t live in Japan, you are not a customer. You are a tourist. And tourists don’t get front-row seats.

Stop pretending this is meant for you. It isn’t. And that’s okay. The world doesn’t need every platform to be global. Some services exist to serve specific communities - and that’s not a flaw. It’s integrity.

Vipul dhingra

16 11 25 / 05:49 AMgmo coin is the only honest exchange left and everyone else is a scam your just mad because you cant use it and you dont even know how to spell japan

Wendy Pickard

18 11 25 / 03:09 AMI appreciate how honest this review is. No fluff. No hype. Just facts. The fact that they don’t publish proof-of-reserves is a red flag - but the fact that they’re regulated at all, and pay you to trade? That’s rare.

I’d use it if I lived in Tokyo. But for now? I’ll stick with Kraken. At least I can message support in English and not feel like I’m begging for help.

Jeana Albert

20 11 25 / 01:19 AMOh my god. I spent 3 DAYS trying to deposit. 3 DAYS. I sent my bank info. They said ‘documents incomplete.’ I resubmitted. ‘Still incomplete.’ I called - no English speaker. I emailed - no reply for a week. I finally gave up and moved to Binance.

This isn’t ‘localized.’ This is exclusion disguised as compliance. And the fact that they charge nothing to withdraw? That’s just to make you think they’re nice while they lock you out of your own money for a week. I’m not impressed. I’m furious.

Chris Hollis

21 11 25 / 01:13 AMLow fees? Cool. But if you can’t deposit, can’t trade altcoins, can’t get support, and can’t even understand the interface - what’s the point?

It’s like buying a Ferrari with no steering wheel because the engine is nice.

Also - no proof of reserves? In 2025? That’s not ‘private.’ That’s sketchy. Just say you’re hiding something.

Jacque Hustead

21 11 25 / 20:03 PMI think people are missing the bigger picture. GMO Coin isn’t trying to compete with Binance. It’s trying to bring crypto to mainstream Japanese households who’ve never trusted exchanges before. The slow KYC? The limited coins? The language barrier? Those aren’t bugs - they’re features designed to reduce risk for ordinary people.

It’s not for traders chasing 100x gains. It’s for teachers, nurses, and retirees who want to hold Bitcoin without getting scammed. And honestly? That’s a noble mission.

Maybe we don’t need more chaos. Maybe we need more stability - even if it’s boring.

Natalie Nanee

23 11 25 / 00:16 AMThey’re getting a business improvement order from the FSA? That’s not a warning - that’s a death sentence. If they can’t fix their compliance internally, they’re not ready for global expansion. And if they’re already failing at home? They’ll implode overseas.

Don’t wait for them to ‘expand.’ They won’t. They’re too busy cleaning up their own mess.

Scot Henry

24 11 25 / 01:53 AMJust wanted to say - the maker rebate is actually genius. It’s not a giveaway. It’s a market design. By paying makers, they’re incentivizing depth in the order book, which reduces slippage for everyone. That’s not ‘niche’ - that’s advanced market structure.

Most exchanges want you to trade fast and often. GMO Coin wants you to trade smart. That’s a different philosophy. And honestly? I respect that.

Louise Watson

24 11 25 / 11:40 AMOnly five coins. No altcoins. No USDT pairs. No card deposits. No English support. No audits. No global access.

It’s not a platform. It’s a museum piece.

Alexa Huffman

26 11 25 / 00:35 AMAs someone who works with Japanese fintech clients, I can say this: GMO Coin is a product of Japan’s unique financial culture - cautious, regulated, relationship-driven. They don’t chase growth. They chase trust.

Yes, it’s slow. Yes, it’s limited. But in a world where 80% of crypto platforms have been hacked or vanished, that caution isn’t a flaw - it’s a feature.

Would I recommend it to a non-Japanese user? No. But I’d recommend it to a Japanese grandmother who wants to hold BTC safely. Absolutely.

Leo Lanham

27 11 25 / 10:00 AMso you're telling me this exchange is like a library that only lets japanese people check out books... and the books are all about how to use a pencil?

bro why am i even here.

Allison Doumith

29 11 25 / 00:08 AMIt’s funny how people act like GMO Coin is some evil monopoly. It’s not. It’s just the only exchange that doesn’t treat users like ATM targets.

They don’t charge withdrawal fees. They pay you to trade. They’re regulated. They’ve never been hacked.

Meanwhile, every ‘global’ exchange is charging you 0.5% to deposit, 0.1% to trade, $10 to withdraw, and then selling your data to advertisers.

Maybe the problem isn’t GMO Coin.

Maybe it’s us - for expecting everything to be fast, free, and global when the entire crypto industry is built on lies.

Angie Martin-Schwarze

29 11 25 / 15:30 PMi tried to sign up… i think i got stuck on the ‘proof of residency’ thing… i sent my us driver’s license… they said ‘not valid’… i cried a little… then i deleted the app…

also… why is the app in japanese… even the buttons say ‘お申込み’… i don’t even know what that means… 😭