Blockchain: What It Is, How It Powers DeFi, and Where to Trade Now

When you hear Blockchain, a public, tamper-proof digital ledger that records transactions across many computers without a central authority. Also known as distributed ledger technology, it’s the reason you can send crypto directly to someone without a bank. This isn’t just tech jargon—it’s the foundation for everything from peer-to-peer payments to automated financial contracts.

Smart contracts, self-executing code that runs on a blockchain when conditions are met make things like lending, trading, and insurance possible without middlemen. And when these contracts connect together—like Lego blocks—that’s called DeFi composability, the ability for decentralized finance protocols to interact and build on top of each other. This is what lets you borrow crypto on one platform, stake it on another, and earn yield on a third—all in one flow. But it also means one broken contract can ripple through the whole system.

That’s why choosing the right tools matters. Not every exchange is built the same. Some, like decentralized exchange, a peer-to-peer platform for swapping crypto without a central operator, let you trade directly from your wallet. Others are locked inside apps with limited options. In 2025, you don’t want to be stuck on a DEX with two trading pairs and no fiat support. Or one that doesn’t even let you move beyond Ethereum. You need options that match your goals—whether you’re avoiding gas fees, chasing yields, or just swapping tokens without leaving your wallet.

What you’ll find below aren’t just reviews. They’re real-world checks on what’s actually working right now. From feeless swaps on IOTA’s EVM to the hidden limits of built-in wallet trading, these posts cut through the hype. You’ll see exactly where blockchain is delivering value—and where it’s falling short.

Are Exchange Tokens Good Investments? Here’s What Actually Matters

Exchange tokens like BNB and OKB offer fee discounts and staking rewards, but they're not safe investments. Their value depends entirely on the exchange's survival - and many exchanges fail. Know the risks before you buy.

Details +Global Crypto Regulatory Convergence Trends: How Nations Are Aligning Digital Asset Rules

Global crypto regulation is finally aligning. MiCA, the EU's landmark framework, is shaping rules worldwide. Stablecoins, exchanges, and issuers now face consistent standards, driving institutional investment and market stability.

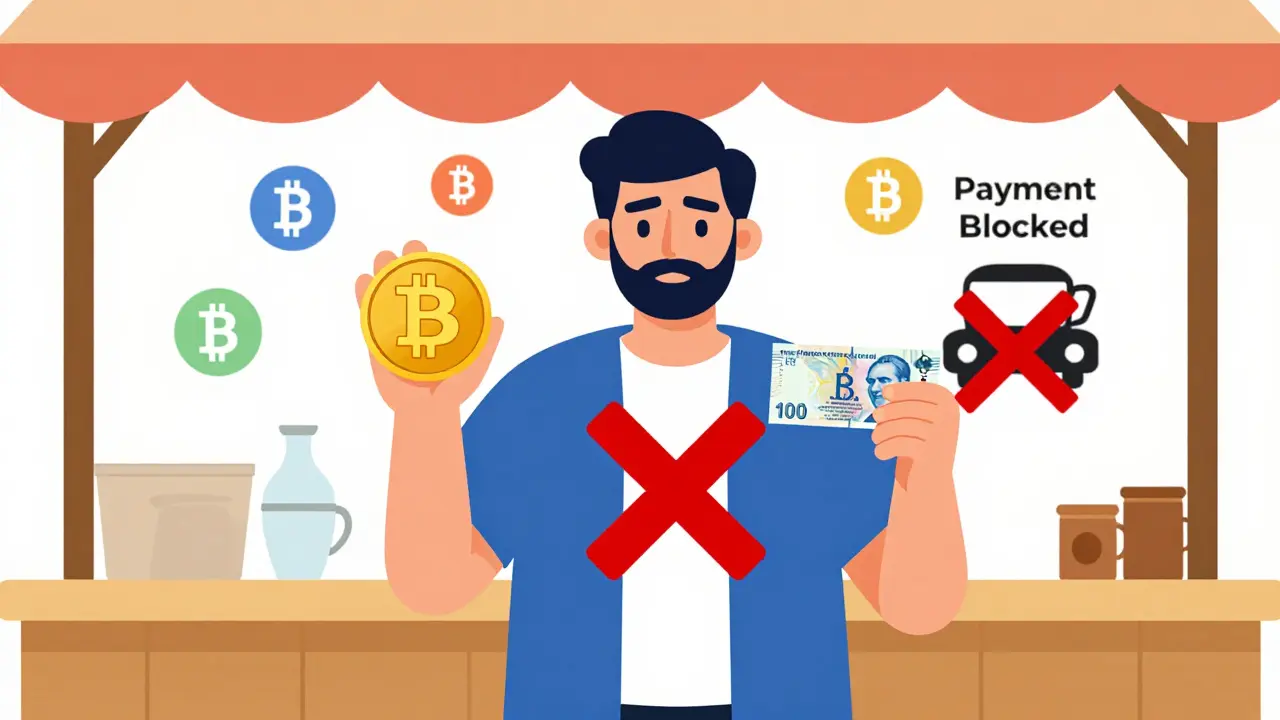

Details +Central Bank of Turkey Crypto Restrictions: What You Can and Can't Do in 2026

Turkey allows crypto trading but bans its use for payments. Learn how the Central Bank of Turkey restricts crypto in 2026, what’s legal, what’s not, and why millions still use it anyway.

Details +REVV x CoinMarketCap Airdrop: What Really Happened and What You Need to Know

The REVV x CoinMarketCap airdrop was a Learn & Earn campaign in 2021, not a free token drop. No new airdrop has happened since. REVV tokens are still used in MotoGP™ Ignition, but trading volume and interest remain low.

Details +How to Report Crypto Scams and Improve Your Chances of Recovery

Learn how to report crypto scams to official agencies like the FBI, FTC, and SEC, and understand why recovery is rare-but reporting still matters. Step-by-step guide with real examples and current 2026 trends.

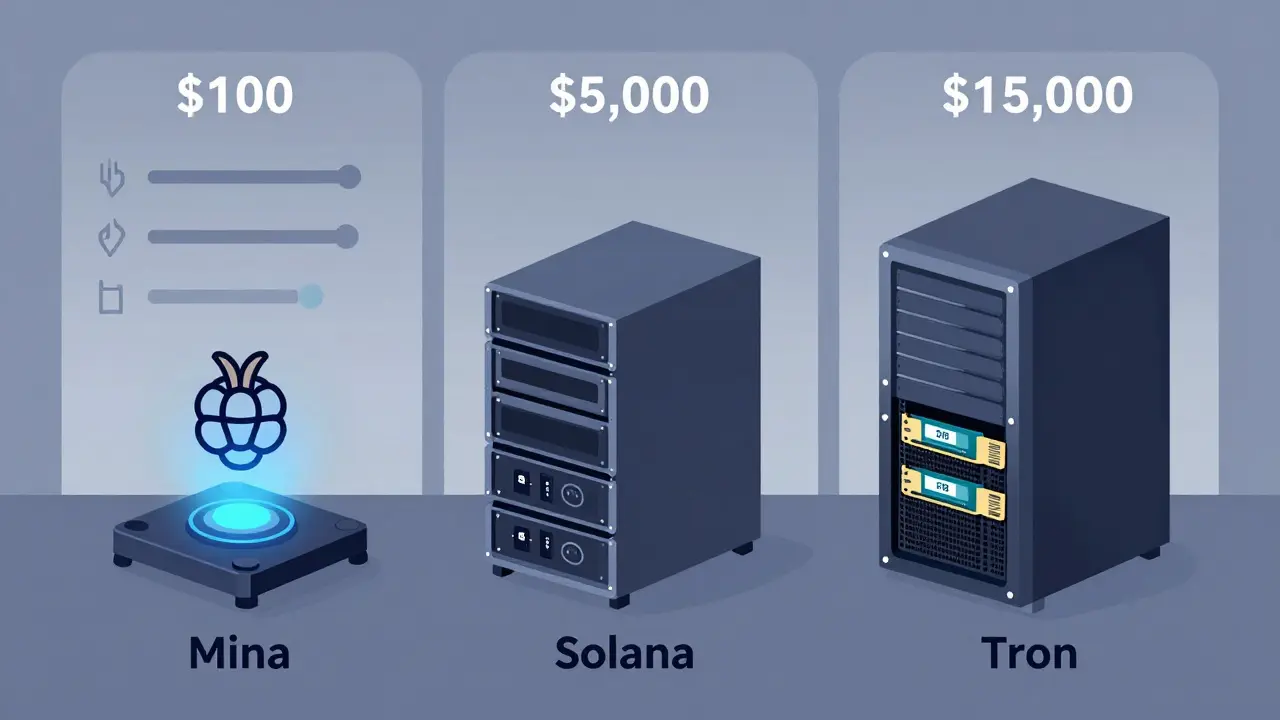

Details +Validator Requirements for Different Blockchains: Hardware, Staking, and Costs Compared

Validator requirements vary drastically across blockchains-from Ethereum's $84K staking threshold to Solana's $5K hardware costs and Mina's lightweight design. Learn the real costs, hardware specs, and hidden fees behind running a validator.

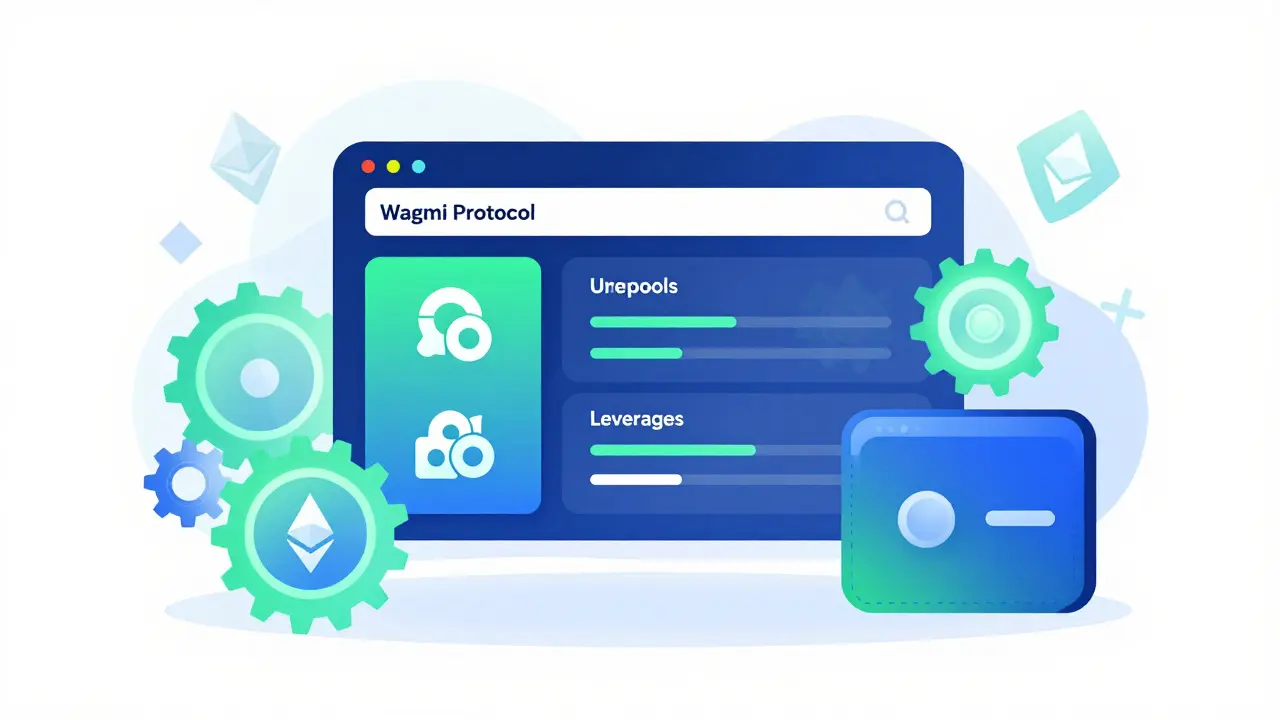

Details +Wagmi Crypto Exchange Review: What It Really Is and How It Works

Wagmi isn't a crypto exchange - it's a DeFi protocol that combines trading, leverage, and liquidity strategies. This review explains how it works, its risks, token utility, and who should use it.

Details +Chinese Crypto Holders: Legal Protection and Risks in 2026

Chinese crypto holders face legal uncertainty: owning Bitcoin is tolerated but unprotected. No courts, no banks, no recourse-just risk. The state promotes its own digital yuan while banning all private crypto.

Details +DragonEx Crypto Exchange Review: Why This Platform Is a Red Flag

DragonEx is a fraudulent crypto exchange with fake reviews, unverifiable licenses, and widespread reports of stolen funds. Learn why this platform is a known scam and what safer alternatives exist.

Details +WSPP Airdrop Details: Wolf Safe Poor People (Polygon) Token Distribution and Current Status

Learn the full story behind the WSPP airdrop by Wolf Safe Poor People on Polygon - what happened, what it’s worth today, and why it’s likely dead. A clear look at the facts, not the hype.

Details +PancakeSwap v3 on Arbitrum: A Real-World Crypto Exchange Review

PancakeSwap v3 on Arbitrum offers low fees, fast trades, and concentrated liquidity for crypto traders. A real-world review of why it's beating Ethereum-based DEXs in 2026.

Details +Gamestarter $GAME Token Airdrop Details: How to Earn and What to Expect

Gamestarter's $GAME token doesn't offer traditional airdrops. Learn how to earn tokens through staking, social quests, and IDO participation. No hype, just real utility in the blockchain gaming ecosystem.

Details +